“In my view it is far too early to write the obituary of shale oil in the U.S,” Dr. Fatih Birol, Executive Director, International Energy Agency, May 15, 2020

As the advisor for the now 38 OECD member nations, the Paris-based International Energy Agency (IEA) helps steer policy for the world’s richest economies with the healthiest, longest-living people. While our global energy-environment discussion continues apace, many consider IEA the most vital of all energy outfits. Importantly, Americans should know that IEA has been a strong supporter of the U.S. shale oil and natural gas revolution that took flight in 2008.

Indeed, this makes sense: oil and gas supply over 60% of the world’s energy. And as an essential supplier, the U.S. is a reliable democracy with predictable laws.

From 2008 to 2019, for instance, yearly average U.S. crude production jumped 150% to 12.3 million b/d. Marketed gas output rose over 70% to about 100 Bcf/d. In turn, the U.S. is now the world’s largest oil and gas producer, set to become the largest exporter of both fuels within a few years. Consider the recent IEA quotes:

• “Updated official estimates of underlying resources mean that the United States still accounts for 85% of the increase in global oil production to 2030 and for 30% of the increase in gas,” March 5, 2020

• “The United States saw the largest decline in energy-related CO2 emissions in 2019 on a country basis – a fall of 140 Mt [million tons], or 2.9%, to 4.8 Gt [gigatons],” February 11, 2020

• “The US shale revolution has reshaped the energy landscape at home and abroad,” September 13, 2019

• “This is going to change the entire dynamics of gas markets, gas security, gas pricing, among others. There are huge expectations around the world for U.S. LNG [liquefied natural gas],” February 28, 2019

The U.S. shale revolution has clearly meant significant economic and national security benefits here at home and for our trading partners. But, perhaps the biggest reason that IEA has been so supportive is that it has installed the U.S. as the global leader in reducing CO2 emissions to abate climate change. Since peaking in 2000, IEA reports that U.S. CO2 emissions have plummeted almost 1 billion tonnes. A vastly improved environment is the quiet but great American success story: “EPA: Much to Celebrate as Earth Day Turns 50.”

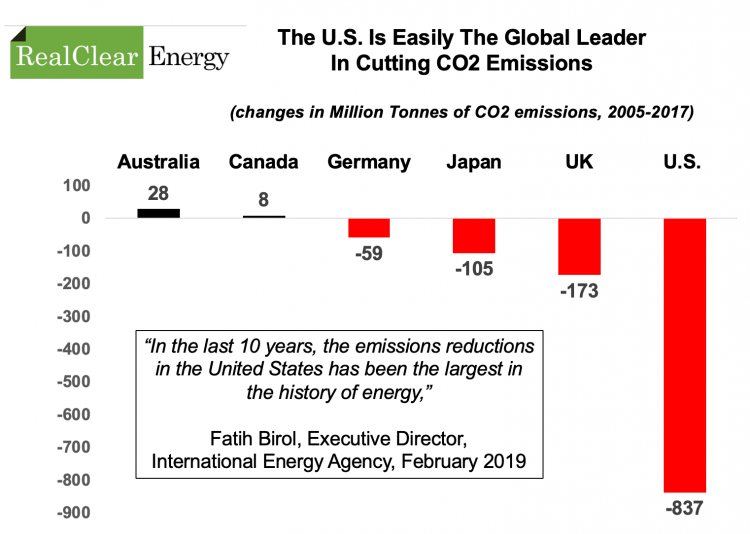

The bulk of this progress has occurred in the power sector, where lower emission and more flexible natural gas has become our centerpiece strategy to displace coal and backup naturally intermittent wind and solar power. In the shale-era since 2008, natural gas has doubled its share of U.S. electricity generation to 40%. From 2005-2017, while global CO2 emissions grew 15% to over 33,200 million tonnes, U.S. CO2 emissions dropped nearly 840 million tonnes, or 15% (Figure). By comparison, China saw its emissions rise 3,130 million tonnes, or a jump of over 50%.

Just as importantly, U.S. CO2 emissions have been falling while the country’s energy prices have remained low. With constant flows of low-cost gas penetrating the system, U.S. electricity prices for families, for instance, have been in the 9-13 cents per kWh range for over a decade. This stands in contrast to Europe, too often cited as the “global leader” in CO2 reduction policy because of its compulsion for regulation and renewables at all costs. Europe’s emissions have not just not declined as previously predicted, but power prices within the continent have been 2-4 times higher than those in the U.S.: “How Electricity Became a Luxury Good in Germany.”

Looking forward, IEA sees the vitality of America’s shale revolution as ongoing, with even a “second wave” coming in the near-term: the U.S. is slated to become the largest oil and gas exporter within four or five years. IEA knows that U.S. energy is crucial to help buffer the geopolitical influence of more risky OPEC and Russia. Those in America pushing the unreality of “no more oil, no more gas” are playing right into their supplying hands: “Intelligence: Putin Is Funding the Anti-Fracking Campaign.”

IEA is therefore relying on the U.S. as the heart of a globally required $11 trillion investment in new oil supply from 2018 to 2040.

After all, oil is the world’s most important fuel and lacks any material substitute. As the effects of COVID-19 gradually fade away, U.S. and global oil demand are now beginning to normalize. There might be a few bumps in the road still, but the trend for oil is clearly up: “China’s Oil Demand Rebounds to Pre-Coronavirus Levels.” In fact, this crisis could actually strengthen oil’s overwhelming dominance.

Without this consistent flow of high investment in new supply, oil’s irreplaceability ensures a price shock and a much deeper and sustained recession to potentially follow.

And always remember that it is a race to lower emissions, not one to install as much renewable capacity as possible. Constantly advancing technology is the engine that drives us. America’s shale industry continues to lower the nation’s CO2 footprint while also cutting methane emissions during its operations. The U.S. Congress can help by making carbon capture, utilization, and storage (CCUS) legislation a top priority and supporting innovative efforts for large-scale mobilization. CCUS has long enjoyed bipartisan support, backed by a group of diverse coalitions.

Surely, wind and solar are growing in importance, but as non-dispatchable technologies their ability to displace dispatchable oil and gas at scale remains more limited than some care to admit. This explains why IEA reports making fossil fuels as clean as possible is a foundation forward:

- “When we consider the scale of the energy and climate challenge, the critical importance of carbon capture is inescapable,” International Energy Agency, February 5, 2020

Indeed, as natural gas marches toward surpassing oil as our most vital fuel and net-zero goals become more popular, “Net Zero Natural Gas Plant — The Game Changer.”

Read it from RealClear Energy – Photo by Magda Ehlers from Pexels