Next-day natural gas prices for Wednesday at the Waha hub in West Texas plunged to record negative levels – meaning some drillers are paying those with spare pipeline capacity to take the unwanted gas and are getting nothing for it.

The drop in prices has been caused by weak demand and recent equipment problems on a key pipeline in New Mexico, analysts said. But pipeline constraints in the Permian basin in West Texas have squeezed gas prices there for some time.

The drop in prices has been caused by weak demand and recent equipment problems on a key pipeline in New Mexico, analysts said. But pipeline constraints in the Permian basin in West Texas have squeezed gas prices there for some time.

The Permian is the nation’s largest oil field, but it also produces large volumes of gas, and the region lacks pipelines to move it.

Spot prices at the Waha hub fell to minus $3.38 per million British thermal units for Wednesday from minus 2 cents for Tuesday, according to Intercontinental Exchange (ICE) data. That beat the prior all-time next-day low of minus $1.99 for March 29.

Prices have been negative in the real-time or next-day market since March 22.

The fall in prices started after El Paso Natural Gas Pipeline declared force majeure on March 18 because of equipment problems at two compressor stations in New Mexico, which cut the amount of gas that could flow west from the Permian.

The fall in prices started after El Paso Natural Gas Pipeline declared force majeure on March 18 because of equipment problems at two compressor stations in New Mexico, which cut the amount of gas that could flow west from the Permian.

Waha prices remained negative even after El Paso, a unit of Kinder Morgan Inc, returned one compressor to service by March 31; the other is expected to be back on April 5.

In addition to the ongoing New Mexico pipeline constraint, Reza Haidari, director of natural gas research at Refinitiv, said the latest price drop was also due to declining heating demand and an increase in power from wind farms that is displacing gas-fired generation in the U.S. Southwest.

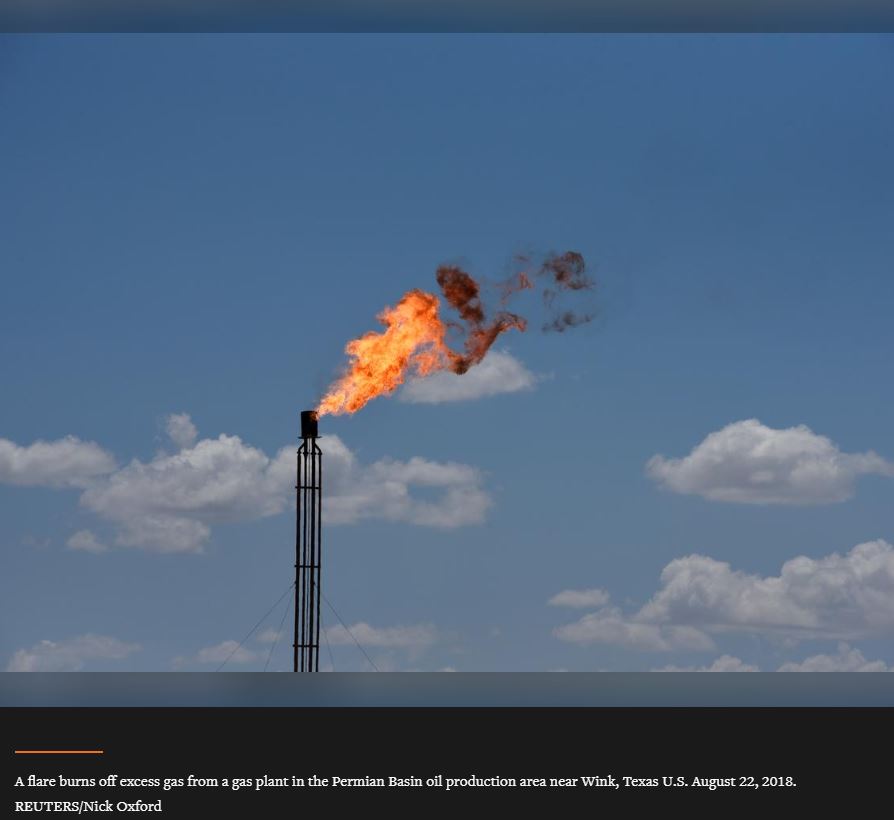

Production of both oil and gas has more than doubled to record highs over the past five years, but Permian pipeline infrastructure has not kept up with output growth. That has forced some producers to burn or flare off some of the gas associated with oil production.

Those constraints have depressed Waha prices, widening its discount to the U.S. Henry Hub benchmark in Louisiana to a record. That spread reached $6.14/mmBtu on Wednesday, topping the prior all-time high of $5.85 in February 1996, according to ICE and Refinitiv Eikon data.

Several new pipelines are in the works, but those projects will not enter service until late 2019 and later.

Photo:

A flare burns off excess gas from a gas plant in the Permian Basin oil production area near Wink, Texas U.S. August 22, 2018. REUTERS/Nick Oxford