One of the basic assumptions or “Paradigms” that is keeping a lid on the price of oil is the belief that U.S. oil production will continue going up year-after-year. This paradigm is second only to the fear that the tariff war between the U.S. and China will go on for years, causing a global recession. FEAR has caused oil prices to fall back into the mid-$50s, not supply / demand fundamentals. It is important that energy sector investors know what’s going on in the real world because $55 oil is not a sustainable price for the world’s most important commodity.

In the real world, upstream oil & gas companies are slashing drilling & completion budgets and the active rig count is falling week after week. Today we aren’t completing enough new wells to offset the accelerating decline rate of existing wells.

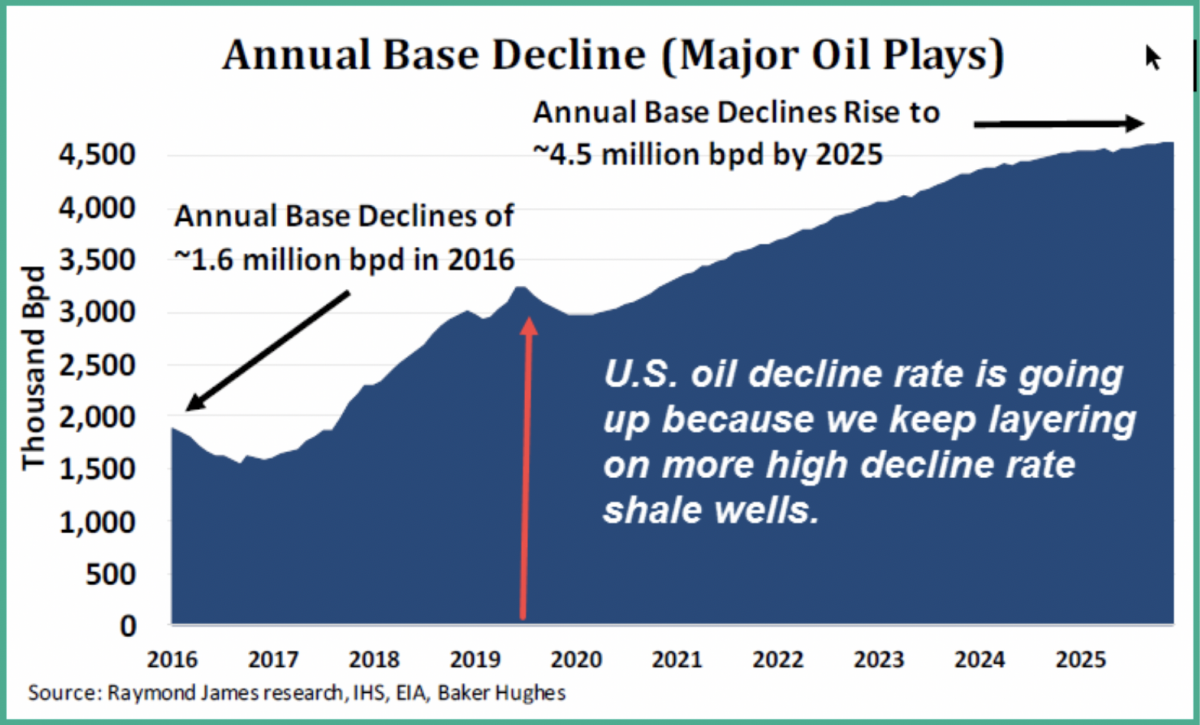

Raymond James recently estimated that over the last three years the U.S. decline rate for oil has doubled from 1.6 to 3.2 million barrels per day. The drilled but uncompleted well inventory (“DUC”) is back to normal, so the number of wells being drilled and the number of wells being completed is now about the same. We need over 12,000 new horizontal oil wells completed each year to hold production flat and the number of completed wells will need to go up each year.

What happens if U.S. oil production stalls or goes on decline?

This is a big question because U.S. production growth has been close to 90% of global oil supply growth over the last three years. If U.S. oil production has peaked, then global supplies will have trouble keeping up with demand growth. Global demand for products refined from crude oil goes up 1.0 to 1.5 million barrels per day year-after year. The only annual decline in demand for oil happened in 2008-2009 thanks to the Great Recession and demand quickly rebounded back to the long-term trend line in 2010. I don’t think Trump’s tariff war with China will cause another Great Recession.Related: U.S. To “Drown The World” In Oil

Let me pause here and say that I believe there is more upside for U.S. oil production. It just isn’t going to happen unless the price of oil goes a lot higher than it is today.

The U.S. Energy Information Administration (“EIA”) forecast at the beginning of this year was that the U.S. shale oil plays were just getting started and that production would increase by at least 2 million barrels of oil per day (“MMBOPD”) each year for several more years.

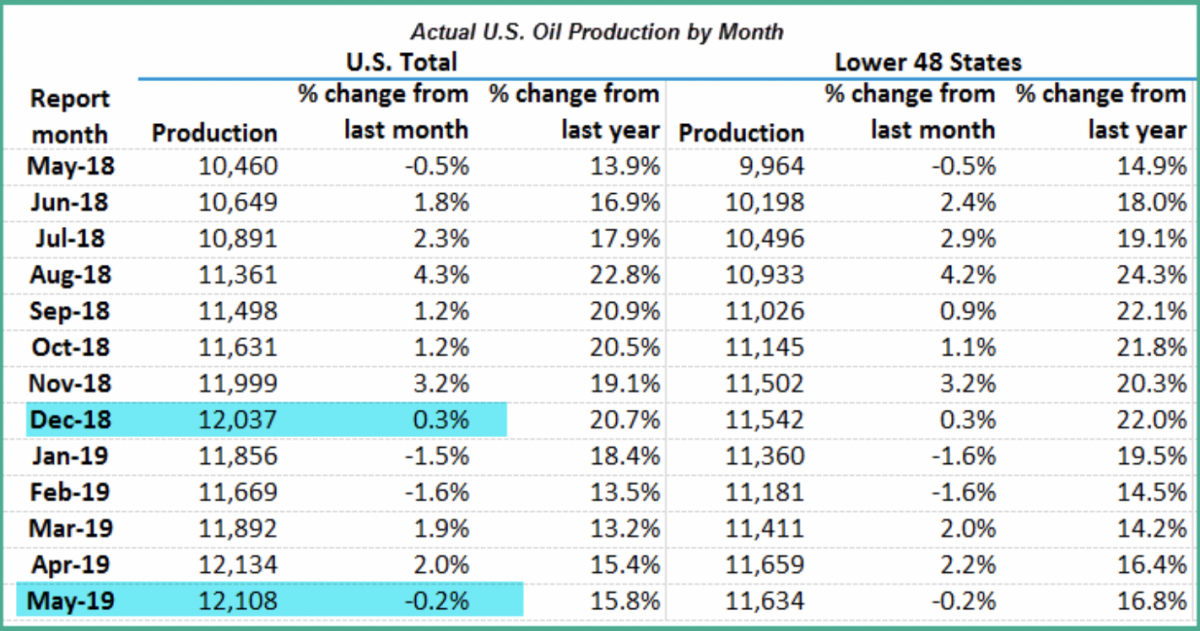

Thanks to the Great Recession, U.S. oil production dipped briefly below 4.0 MMBOPD in September 2008 but rebounded to over 5.3 MMBOPD within six months. The “Shale Revolution” started around 2010; saving the U.S. oil & gas industry. Jumping forward, U.S. crude oil production increased 2.4 MMBOPD from 9.7 MMBOPD in December 2017 to 12.1 MMBOPD in December 2018. EIA’s projection that oil production would go up at least 2.0 MMBOPD this year seemed reasonable back in January, but shale oil production has definitely hit a wall.

The chart above is taken directly from the EIA website. Note that after a 539,000 barrel per day surge in U.S. oil production from September to December of 2018 U.S. production declined in the first quarter of this year. After a nice increase in April, production pulled back again slightly in May. May is the last month for which we have actual production data.Related: Hong Kong Billionaire Loses $20 Billion In Canadian Oil Sands

The EIA appears to have figured this out, but the International Energy Agency (“IEA”) based in France is still telling the world that the U.S. can keep the world well supplied with cheap oil.

EIA’s weekly oil supply estimates are just “guesses” based on their formulas. They don’t have measuring devices on the more than a million oil wells producing in the U.S. Since the end of May (area highlighted in yellow in the chart below) EIA has been reporting that U.S. oil production has been flat. The big dip in mid-July was caused by Hurricane Berry.

(Click to enlarge)

My conclusion is that upstream companies in the U.S. are not completing enough new wells to offset the increasing decline rate. My “guess” is that U.S. oil production peaked sometime in April or May. If this is confirmed by a few more months of actual production data provided by state agencies on a 90-day lag, I think there may be a big “Paradigm Shift” that causes a lot of investors to add more energy to their portfolios.

I follow close to 100 upstream oil & gas companies. I’ve never seen the market sentiment toward the sub-sector so negative. Dozens of profitable oil companies that I follow are trading at single digit PE ratios and multiples of cash flow from operations that I never dreamed possible. This world runs on oil and there is nothing that is going to change that anytime soon. That is the real world we live in.

By Dan Steffens for Oilprice.com

Read it from OilPrice.com – Picture as posted on Oil Price