Saudi Arabia is slashing shipments of crude to the United States, a move that appears calibrated to boost oil prices after a swift and punishing sell-off.

The move could put the kingdom at loggerheads with President Donald Trump, who wants to drive down energy costs for Americans and frequently accuses the Saudi-led OPEC cartel of jacking up oil prices.

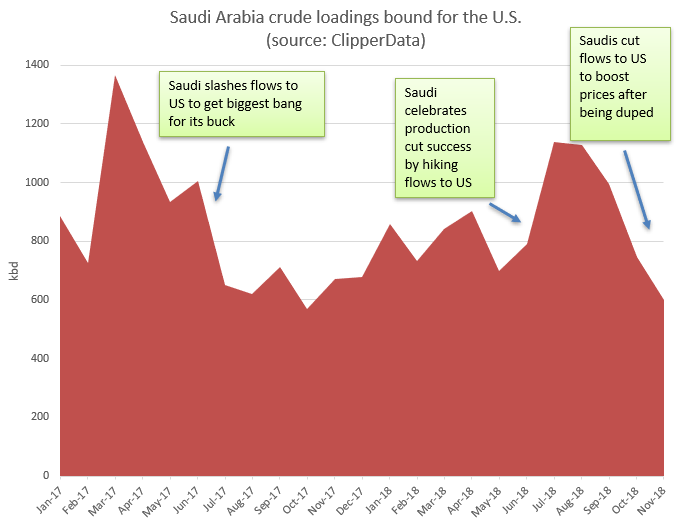

The Saudis are loading fewer barrels on ships bound for the United States this month, continuing a trend that began in September, according to an analysis by tanker-tracking firm ClipperData. The firm’s loading estimate suggests that U.S. imports of Saudi crude oil could soon fall toward the lowest levels on record.

Sending fewer barrels to the United States means U.S. crude stockpiles are more likely to drop, and shrinking inventories tend to push up oil prices. It’s a tactic the Saudis used last year to amplify their main strategy for draining a global crude glut and propping up the market: cutting output alongside fellow OPEC members, Russia and several other producers.

The maneuver shows how Saudi Arabia’s efforts to manage the oil market have evolved. During the 2014-2016 oil price crash, traders closely monitored weekly U.S. stockpile data to see whether oversupply was shrinking or growing. As the world’s biggest exporter, Saudi Arabia realized it could nudge the data in a direction that boosts the cost of crude.

“It worked so well in 2017 for [the Saudis] to cut flows to the U.S. because people could see the inventories dropping because U.S. data is so timely and transparent,” said Matt Smith, head of commodities research at ClipperData.

“The markets have become more transparent through tanker tracking,” Smith said. “You can see those changes being implemented more, and [the Saudis are] aware of that.”

November’s drop in Saudi barrels bound for the United States follows a six-week oil market rout that saw prices plunge 25 percent into bear market territory. It also comes after Saudi Energy Minister Khalid al-Falih warned on Monday that OPEC, Russia and several other producers may soon launch a fresh round of price-boosting output cuts.

Shortly after Falih issued the warning, Trump took to Twitter to voice his disapproval with that plan.

But Saudi Arabia may not be swayed by Trump’s pressure campaign. In recent days, Smith and other energy analysts have claimed that Trump essentially duped OPEC and its allies into raising output earlier this year.

The analysts say Trump’s threats to impose harsh sanctions on Iran, OPEC’s third-biggest producer, played a part in convincing the producers to stop capping output and start pumping more oil. But Trump ultimately allowed some of Iran’s biggest customers to keep importing its oil, which meant the oil squeeze the alliance feared never materialized.

Consequently, the producers put even more oil into a market that is swinging toward oversupply, giving traders another reason to sell off crude futures and push prices lower.

While the Saudis are probably not happy about that outcome, Smith says cutting oil shipments to the United States does not appear calibrated to punish Trump. Instead, it’s simply about preventing another oil glut and boosting prices.

Cutting production while shrinking shipments to the United States offers “the biggest bang for the buck,” according to Smith.

Still, it’s a direct challenge to Trump’s goal of pushing oil prices even lower.

On Sunday, Falih, the Saudi energy minister, said the kingdom’s oil shipments would fall by 500,000 barrels per day in December. The following day, he said OPEC and its partners could slash their collective output by 1 million bpd next year.

ClipperData figures show the Saudis are loading roughly 600,000 bpd on tankers bound for the United States this month, down from more than 1 million bpd in July and August. If official trade figures end up matching ClipperData’s loading estimates, U.S. imports of Saudi crude are heading toward record lows.

Saudi loadings for the U.S. market rebounded through August after the OPEC alliance hiked output. Those shipments generally take six to seven weeks to reach U.S. shores.

“The last of that has just been hitting the U.S. Gulf in the last few weeks,” Smith said. “But now, as those export loadings have dropped off in September and October, that means there’s going to be a dearth of deliveries as we close out the year.”

On Thursday, government data showed U.S. crude stockpiles rose for an eighth consecutive week, jumping by 10.3 million barrels. The drop in Saudi shipments in recent months could soon help to whittle away at those inventory levels.

Photo:

Heinz-Peter Bader | Reuters