Despite fears of a second wave of COVID-19, oil markets rebounded last week, showing signs of improving fundamentals as global supplies continue to tighten. On Friday, Brent closed at $42.19, up by 8.20 percent w/w, while WTI closed at $39.75, up by 9.03 percent w/w. Furthermore, the 1-2 month Brent spread flipped into backwardation for the first time since the third of March which is a major sign of tightening supplies resulting from OPEC+ cuts. Yet, it is expected that 500 thousand bbl/d of shale oil, mainly from the Permian, will come back online by the end of June as a result of the price recovery. Oil demand is currently said to stand close to 90 million bbl/d, 5 million bbl/d above our earlier forecast. U.S. oil inventories rose by 1.7 million barrels w/w according to the EIA’s latest figures, while U.S. oil production stands at 10.5 million bbl/d, down by 1.7 million bbl/d y/y. U.S. oil rigs saw a 15th consecutive week of decline, dropping by 10 rigs to bring the total number of rigs to 189. There are plenty of positive signs for oil markets, with the return of economic activity around the world. The manufacturing PMI rose to 43.1 in May from 41.5 in April 2020.

- There is plenty of bullish sentiment in oil markets despite fears of a second wave of COVID-19 cases and under compliance from some OPEC+ members.

- The second half of 2020 should see oil prices rise to $50 on the back of a global demand recovery and controlled cuts from OPEC+.

- Money managers reduced their net long positions last week, highlighting the downside risks in the near-term.

Nonetheless, money managers seemed cautious as they reduced their net long positions by 26,982 w/w in WTI contracts reaching 354,363. This move seems to have been driven by fear of demand weakness amid a new wave of COVID-19 outbreaks in both China and the U.S.

IEA and OPEC reports

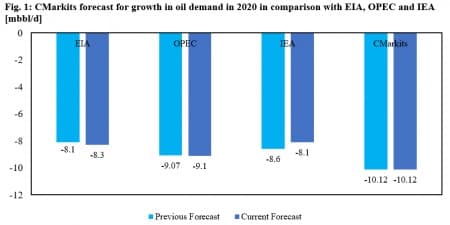

Oil prices were buoyed by the IEA oil market report which raised its demand outlook for this year by 0.5 million bbl/d. The IEA is optimistic about demand recovery through 2020 and 2021 which led to price support last Tuesday and Wednesday. Currently, the IEA estimates that oil demand will fall by 8.1 million bbl/d in 2020, before recovering by 5.7 million bbl/d in 2021. Furthermore, the IEA expects global oil output to be set for a modest 1.7 million bbl/d recovery in 2021, assuming an easing of OPEC+ cuts, rising supplies from Norway, Brazil and Guyana and a sustained recovery of Libyan production. The IEA also expects U.S. supply to fall by 0.9 million bbl/d in 2020 and a further 0.3 million bbl/d in 2021 unless higher prices unlock fresh investments in the shale oil sector.

On the other hand, the latest OPEC report saw its demand forecast for 2020 unchanged at a decline of 9.1 million bbl/d y/y including a decline by 6.4 million bbl/d in H2 2020 which will mainly come from OECD countries. Despite an easing of lockdown measures around the world and an unprecedented economic stimulus, 25 percent of global GDP, the organization sees continued pressure on transport fuel demand in H2 2020. Gasoline consumption is forecast to be restrained due to high unemployment in the U.S. and reduced commuting trips. Furthermore, aviation fuel, the hardest hit fuel, is unlikely to recover any time soon as national and international flights are anticipated to see a very slow recovery. Outages in North American production are expected to reach a combined 2.8 million bbl/d in H2 2020 in the U.S. and Canada. Another output drop by 1.7 million bbl/d is expected to come from the 10 non-OPEC countries participating in the OPEC+ agreement. On the other hand, secondary sources showed that OPEC production stood at 24.195 million bbl/d in May, down by 6.3 million bbl/d m/m with a compliance rate of 85.13 percent.

OPEC+ JMMC

OPEC+ reported a total compliance of 87 percent in May during its JMMC meeting last week, which is much higher than what many market participants had expected. Russian compliance reached 90 percent in May as confirmed by the Russian Energy Minister. Furthermore, those countries which have fallen behind their targets in May and June have been told to compensate for their missing targets in July and August. It is expected that the current cuts of 9.6 million bbl/d, which have been extended until the end of July, will not continue through to the end of the year. The OPEC+ JTC, which held its meeting before the JMMC, did not recommend extending current cuts in place beyond July which is, in our view, a decision based on rising demand figures, especially in China. A press conference for the group led by the Saudi and Russian Energy ministers is expected to be held this week. Meanwhile, Iraq and Kazakhstan have submitted their compensation plans for the months of July and August while Nigeria and Angola are yet to do so. Iraq’s promise to the JMMC is that it will compensate for producing 0.573 million bbl/d above its quota in May by undercutting its production by 57 thousand bbl/d in July and 258 thousand bbl/d in August and September. That means Iraq will keep its production flat from July to September when OPEC+ eases its cuts by 2 million bbl/d. The next JMMC will take place on the 15th of July as per the group’s new policy of having a monthly meeting.

Our Forecast for H2 2020

We see global demand rising to an average of 91.67 million bbl/d and 93.67 million bbl/d in Q2 and Q3, respectively, while global supply is currently forecast to average 88 million in the H2 2020. The continued rise in prices is crucial if we are to see increased supplies from both OPEC+ and North America. CMarkits expects inventories in both the U.S. and OECD to stay above the 5-year average throughout H2 2020, which could limit price recovery in the months ahead. Subject to strengthening economic activities in China, India, the U.S. and Euro-Zone, we see prices continuing to rise above $50 in H2 2020, averaging $43 in Q3 and $49 in Q4.

Read it from OilPrice – Photo as posted on OilPrice