Natural gas producers have gone through a much tougher period than oil producers. First, natural gas prices fell from $7/MMBtu average in the pre-2008 era, then prices averaged $3.50+/MMBtu between 2010 and 2014, and now, recently, where prices averaged sub $2/MMBtu for the first 6 months of 2020.

So, is it hard to believe that no one thinks an incoming supply led deficit will be sustained?

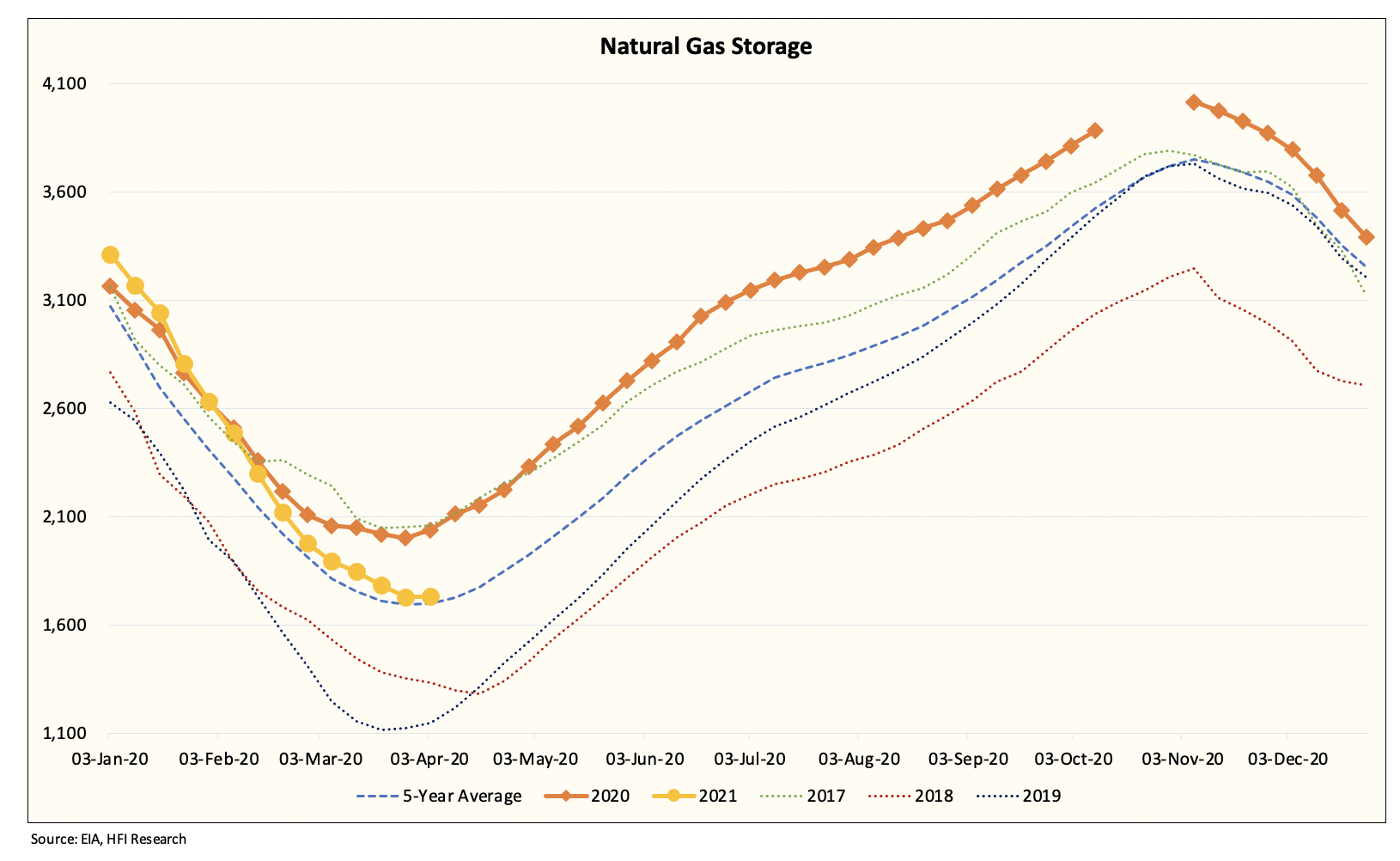

But as we wrote in an article a month ago titled, “Natural Gas Market Deficit Over Winter May Exceed 5 Bcf/D This Coming Cold Season.” Irrespective of the weather outlook over the winter, the bear case still has natural gas storage falling to the 5-year average due to the incoming supply deficit.

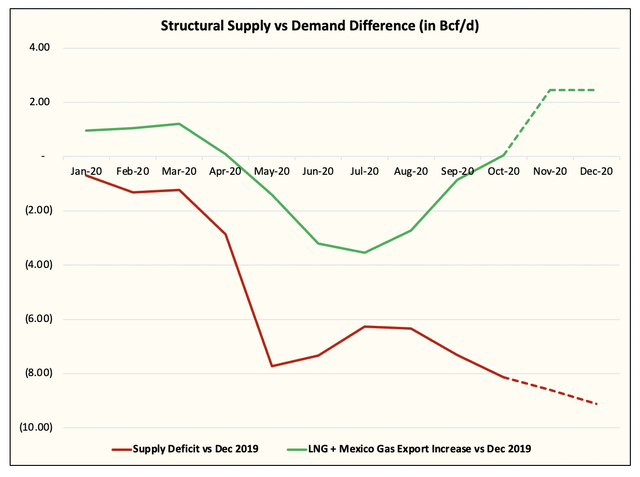

And it’s easy to understand why this is the case. Consider the following chart illustration:

Source: EIA, HFI Research Estimate

As you can see above, excluding other demand variables like power burn, residential/commercial, and industrial, you can see that the structural increase in US natural gas exports via LNG and Mexico will increase ~2 Bcf/d y-o-y.

On the supply side, we will have decreased ~9 Bcf/d y-o-y by the end of 2020.

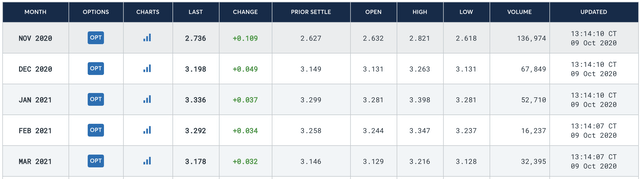

This mismatch in supply and demand is why we said that this winter’s supply deficit could be as large at ~5+ Bcf/d, which would essentially eliminate the importance of weather and skew the natural gas market to the upside. This is also another reason why you see the winter contracts trading so high even before winter starts and despite bloated storage.

Source: CME

What we have going in the natural gas market is a really long-time in the making. Natural gas is the most evident market of the stupendous outspending by US shale producers. There’s no OPEC+ to intervene, and natural gas is truly the purest form of a commodity where any slight imbalance in supply and demand could wreak havoc on prices.

The question for anyone that’s watching the natural gas market closely is what will the producers do now that the 2021 curve is sitting comfortably around ~$3/MMBtu. Will they increase capex, increase production, and thus start dwindling the supply deficit? Or will they have actually learned their lesson, stay disciplined, and reward shareholders with the excess FCF?

Companies have not given guidance yet on 2021, but names like Cabot Oil & Gas (COG) have already stated that any excess FCF will be used towards debt repayment and shareholder-friendly capital allocation policies. EQT (NYSE:EQT) is likely to follow a similar approach, so the question really boils down to the others like Range Resources (RRC) and Antero (AR). Will they materially increase spending? Or have they learned their lesson that years of low gas prices do shareholders no good?

The question can’t be answered until we see the capex guidance, but based on all of the signs we’ve seen and the points management teams have hammered away in the last two quarterly conference calls, we think natural gas producers have learned their lessons the hard way.

In addition, what’s also likely keeping natural gas producers from considering materially increasing spending is the debt maturity wall that’s coming up. Combine that with a lack of capital and we may really have ourselves a 2-3 year runway on higher natural gas prices.

It’s been a long-time in the making, but the natural gas market is sorting itself out. A supply-led deficit is coming, so brace yourself.

Read it from seekingalpha – Photo as posted on seekingalpha