Despite analysts’ dire predictions about Covid-19’s short-term/long-term effects on the industry, demand and oil prices recovered significantly in second-and-third-quarter 2021. Even with consistently higher oil prices, U.S. operators showed uncharacteristic restraint, focusing on debt reduction and shrinking the DUC backlog rather than new drilling.

The U.S. petroleum industry faced continued pressure from President Biden and environmental groups, who have repeatedly stressed the imperative of reducing fossil fuel usage to slow GHG emissions. However, the hard push to convert has left the U.S. undersupplied, underpowered and vulnerable to weather-related events.

In February, Texas experienced a major failure of its power grid, due mainly to decades of poor policy decisions that prioritized climate change politics at the expense of reliable power supply. In May, IEA stated “ending new oil and gas exploration today is the only viable climate path to achieve net-zero carbon emissions by 2050.” The world’s largest producers rejected this call for a rapid shift away from oil and gas, warning that starving the industry of investment would harm the global economy and cause large spikes in oil prices.

In addition to the push for renewables, the spread of Covid-19 continued to cause widespread disruption to commodity markets further damaging the industry during first-half 2021. To support crude markets, Saudi Arabia reduced oil production in February 2021 by 10.4%, down to 8.15 MMbopd. Production in the U.S. declined 6.3% in February, dropping to 10.4 MMbopd, most likely due to lower commodity prices. Russian output remained relatively steady during this timeframe. However, as vaccines stared to curb virus outbreaks, pent-up demand caused WTI prices to surge to $75.37/bbl in July 2021, the highest recorded spot price since October 2018, when WTI was trading at $76.40/bbl.

Demand will continue to recover. The head of Vitol Group, the world’s largest independent oil trader, expects crude demand to continue to recover in 2021 and 2022 as the world emerges from the pandemic. Demand for crude will increase by 7-to-8 MMbopd by the end of 2022, up from current levels, and producers will be stretched to meet that surge, according to Vitol CEO Russell Hardy. “We will need the industry at full strength to get through 2022,” Hardy said. “We believe $70-to-$75/bbl is possible for the third/fourth quarters.”

MACRO U.S. PICTURE

The Baker Hughes rotary rig count stood at 360 units during the week ending Jan. 8, 2021. That total is 55% less, or 436 rigs fewer, than were working on Jan. 3, 2020, Fig. 1. U.S. drilling activity steadily climbed for the next seven months, hitting 512 during the week ending Sept. 17. Although the 152-rig increase represents a 42% Jan.-Sept. increase, U.S. shale operators have resisted ramping-up drilling activity, remaining disciplined with capital expenditures. The speed at which new rigs have been deployed to the field is considerably less than in previous up-price cycles. Most U.S. shale companies are being conservative, as priorities remain focused on protecting balance sheets and generating free cash flow.

With oil trading above $70/bbl, even while investment activity remains low, the world’s publicly traded E&P companies are set to generate record-breaking free cash flows in 2021 (Rystad Energy). Their combined cash flow from upstream activities should surge to $348 billion this year, with the previous high being $311 billion in 2008. Total gross revenue for all public upstream companies should increase by $500 billion in 2021, or 55% compared to last year (excluding hedging effects). At the same time, the investment level of these companies is only expected to grow 2% in 2021, resulting in significantly higher profits.

OVERALL U.S. FORECAST

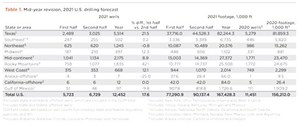

With demand returning and oil prices firming, World Oil forecasts a moderate uptick in drilling activity for the remainder of the year, projecting 12,452 total wells for 2021—a 9% increase from the 2020 count of 11,451, Table 1. Total footage is projected to increase from 156.2 MMft in 2020 to 167.4 MMft in 2021—an increase of 7%. During 2021, 5,723 wells are estimated to have been drilled during the first six months, while 6,729 are expected to spud in the second half of the year, for a half-to-half increase of 17.6%. A 16.6% increase in footage is expected in the last six months.

We have some confidence in this forecast, given that our February 2021 winter forecast was only 130 wells different from this round. And these predictions are backed up by survey numbers in various key areas of the U.S.

M&As back in vogue. The spread of Covid caused revenues to decline substantially, leading to a pullback in spending. It also reduced M&A activity. There were only 205 deals across the sector in 2020, the lowest number in more than a decade. However, in 2021, several blockbuster deals are scheduled to close.

In September, Shell Enterprises reached an agreement for the sale of its Permian business to ConocoPhillips for $9.5 billion in cash. The transaction will transfer all of Shell’s interest in the Permian to ConocoPhillips, subject to regulatory approvals. “After reviewing multiple strategies for our Permian assets, this transaction with ConocoPhillips emerged as a compelling value proposition,” said Wael Sawan, Shell’s upstream director. “This decision reflects our focus on value over volume, as well as disciplined stewardship of capital. The cash proceeds will be used to fund $7 billion in additional shareholder distributions after closing, with the remainder used to strengthen the balance sheet. The effective date of the transaction is July 1, 2021, with closing expected in Q4 2021.”

In May, the merger of Cabot Oil & Gas with Cimarex Energy was announced in an all-stock transaction valued at $7.4 billion. However, the union confused investors, leaving them to question the logic behind a combination that the companies say will increase diversification. Cimarex is mostly an oil explorer in Texas and Oklahoma, while Cabot is focused on natural gas drilling in the Marcellus. Although the two companies are following a path outlined by other shale companies of late by clinching a deal involving almost no takeover premium, it wasn’t enough to win over investors. Shares of both companies slumped after the announcement. Analysts at Citigroup said the deal was an unexpected pairing, as it creates geographic diversity, unlike other recent industry transactions. KeyBanc Capital downgraded shares of Cimarex because of the lack of a premium and what it views as no clear strategic benefit to investors. Bloomberg Intelligence said a Permian-focused partner would have made more sense for Cimarex. Investors questioned why in-basin opportunities weren’t pursued ahead of a surprising multi-basin deal.

By contrast, enthusiasm permeated through markets in April, when Bonanza Creek Energy and Extraction O&G announced an all-stock deal valued at $1.1 billion that will combine assets in Colorado. The merger—a low-premium deal—was favored among shareholders, as it aims to build on the companies’ existing footprint in the area. Shares for Bonanza and Extraction surged as a result. The number of U.S. E&P deals announced or closed this year has more than quadrupled to about $26 billion from the same period a year earlier.

OFS outlook improving. In July, Haliburton confirmed that for the first time in seven years, the company is expanding in U.S. and foreign markets, as spending recovers in the global energy industry. “The economy feels more than 2% shut in, so the demand growth is there,” said CEO Jeff Miller. “Drillers are going to require a lot of services, as we meet global demand for oil and gas. Exploration customers are profitable at current oil prices in the $60-$70/bbl range, and spending could increase by percentages in the double digits over the next several of years as a result.” The bullish outlook from the world’s third-largest OFS provider follows comments in May from Schlumberger, which said the global economic recovery could trigger an energy-industry “supercycle” that should lead to wider margins.

Thanks to tightening supplies of various oilfield gear, Halliburton said it’s finally able to command higher prices for its work—beyond the cost of supply chain inflation—in certain markets. The optimistic outlook is a dramatic rebound for the sector, which was laid low last year by the pandemic and forced to layoff 10,000s of workers. The three biggest OFS companies—Halliburton, Schlumberger and Baker Hughes—are expected to increase profits by 20% in the third quarter, compared with the first three months of the year.

Green strikes again. A nationwide push for green energy could strand $68 billion in coal and natural gas assets (S&P Global Market Intelligence). Analysts estimate that $34 billion in coal plant investment and another $34 billion in new gas plant construction could be at risk to meet ambitious decarbonization goals outlined by the Biden administration’s Clean Energy Standard. During the last 10 years, U.S. electric sector carbon emissions have declined, mainly due to the substitution of coal generation with natural gas generation.

However, recent pricing trends indicate further emissions reductions using this avenue are unlikely. The advancement of renewable mandates and regulatory support for retiring coal generation in parts of the country indicate that a new round of carbon emission reductions is on the horizon. This push could reduce the value of recent investments in pollution control equipment at coal plants and put pressure on the U.S. fleet of recently built natural gas generation infrastructure.

Employment opportunities. The American oilfield services and equipment sector’s employment rose by an estimated 3,711 jobs in August, a sixth straight month of growth, according to preliminary data from the Bureau of Labor Statistics (BLS) and analysis by the Energy Workforce & Technology Council (Council). However, the rate of growth slowed to 0.6%, reflecting sluggish employment growth across the nation’s economic sectors. Among other key findings, the sector has added more than 42,000 jobs over the six months since hitting a pandemic low of 597,067 jobs in February, according to BLS data. Also, sector job losses peaked at more than 109,000 positions. Since then, the sector has regained 42,200 jobs, bringing total pandemic losses to 67,200.

Against this cautiously optimistic outlook, World Oil presents its 2021 U.S. mid-year forecast.

Drilled-but-uncompleted wells decline. According to the August 2021 tally by EIA, the DUC total stood at 5,713, a reduction of 1,952 wells since August 2020. In the Permian basin, operators have completed 1,413 DUC wells during the August 2020-August 2021 interval, a 40% reduction. Also, an analysis by Rystad Energy shows that drilling discipline has reduced the number of “live” DUCs (less than two years old) in the major shale regions. The number of “live” DUCs stood at 2,381 in June 2021, the lowest level since 2013, as the industry continues to whittle down the number of DUCs through fracing.

CAPEX FORECAST

Fig. 2. As shown in this all-time U.S. drilling chart, activity in 2021 is improving upon the worst year for U.S. activity since 1898. By all indications, 2021 will be up about 9% from the 2020 low point. Image: ©World Oil.

North American spending is forecast to decrease 6.5% from 2020 levels, which is a reversal from 5.4% growth suggested by a December survey, according to James West, senior managing director at Evercore ISI. Although capex in Canada is stabilizing near current levels, with anticipated 3% growth for 2021, capex in the U.S. is expected to contract for a third straight year and for the fifth time in the last seven years, due to a combination of consolidation, bankruptcies and corporate dissolutions. The structurally smaller U.S. and Canadian markets are less than one-third and 16% of their 2014 peaks, respectively.

Spending plans contracted quickly for the U.S. and Canada following the collapse of commodity prices in March 2020, as E&Ps prioritized preserving liquidity, given the uncertain impact of the global pandemic on oil demand. A restructuring cycle among public E&Ps gave way to a smaller and less fragmented industry, but it is now largely complete with the emergence of stronger regional majors and independents. Excluding the historical capex of distressed companies that have since been acquired or privatized, U.S. capex is falling by a relatively modest 1.2% in 2021 and growing by 21% in Canada. From a lower base, Evercore believes the set-up is positive for growth in 2022 and beyond.

There could be modest upside to North American spending during second-half 2021, with current WTI spot prices above the $54/bbl average basis for establishing 2021 budgets. While two-thirds of spending survey respondents would maintain their budgets, regardless of changes in the oil price, one in five would increase capex, due to corresponding increases in oil prices.

EIA FORECAST

The EIA’s Short-Term Energy Outlook, published September 2021, reports that STEO remains subject to heightened levels of uncertainty related to the ongoing recovery from Covid-19. U.S. economic activity continues to rise after reaching multi-year lows in the second quarter of 2020, while U.S. GDP declined 3.4% in 2020 from 2019 levels. This STEO assumes U.S. GDP will grow 6.0% in 2021 and 4.4% in 2022. The EIA forecast assumes continuing economic growth and increasing mobility.

Oil price forecast. Brent spot prices averaged $71/bbl in August, down $4/bbl from July but up $26/bbl from August 2020. Brent prices have risen over the past year as a result of steady draws on global oil inventories, which averaged 1.8 MMbopd during the first half of 2021. EIA expects Brent prices will remain near current levels for the remainder of 2021, averaging $71/bbl during fourth-quarter 2021. In 2022, we expect that growth in production from OPEC+, U.S. tight oil, and other non-OPEC countries will outpace slowing growth in global oil consumption and contribute to Brent prices declining to an annual average of $66/bbl.

Crude production forecast. More than 90% of crude production in the federal Gulf of Mexico offshore was offline in late August following Hurricane Ida. As a result of the outage, GOM production averaged 1.5 MMbopd in August, down 0.3 MMbopd from July. EIA expects that oil production in the GOM will gradually come back online during September and average 1.2 MMbopd for the month before returning to an average 1.7 MMbopd in the fourth quarter. Total U.S. output averaged 11.2 MMbopd in August—the most recent monthly historical data point. EIA forecasts that it will remain near that level through the end of 2021 before increasing to an average 11.7 MMbopd in 2022, driven by growth in onshore tight oil production.

Natural gas prices. In August, spot price for natural gas at Henry Hub averaged $4.07 MMBtu, which was up from the July average of $3.84/MMBtu. The August increase reflects hotter temperatures in August, on average, across the U.S., compared with July, which caused demand for natural gas in the electric power sector to be higher than expected. Henry Hub spot prices in August were $1.77/MMBtu higher than in August 2020. Steadily rising natural gas prices over the past year primarily reflect: 1) growth in LNG exports; 2) rising domestic natural gas consumption for sectors other than electric power; and 3) relatively flat natural gas production. EIA predicts that Henry Hub spot price will average $4.00/MMBtu in the fourth quarter, as the factors that drove prices higher during August lessen.

Natural gas production. Approximately 90% of natural gas production in the GOM was offline in late August following Hurricane Ida. GOM production of marketed natural gas averaged 1.9 Bcfd in August, down 0.4 Bcfd from July. EIA expects natural gas production in the GOM will gradually come back online during the first half of September and average 1.5 Bcfd for the month before returning to an average 2.1 Bcfd in the fourth quarter. Natural gas production will average 92.7 Bcfd during second-half 2021—up from 91.7 Bcfd in the first half of the year. It will increase to 95.4 Bcfd in 2022, driven by higher gas and crude prices, which are expected to remain at levels that will support enough drilling to sustain production growth.

U.S. FORECAST

Fig. 3. As represented by the Turritella FPSO at the Stones producing field, Gulf of Mexico activity will be on the upswing in 2022. The Stones development is the world’s deepest oil and gas project, operating in around 9,500 ft of water in an ultra-deep area of the U.S. GOM. Image: Shell Oil Co.

Given the strong recovery in demand, and resulting increase in crude prices, operators working the various U.S. plays plan to moderately increase drilling activity for the remainder of 2021, Fig. 2. Overall, activity in the oil-rich Texas shale plays will improve in the second half of the year, with the exception of District 5, which will suffer slight second-half losses. However, drilling on the Texas side of the Haynesville is projected to improve 14% on a y-o-y basis. Gulf of Mexico activity will dip slightly, but some moderate improvement is forecast offshore California.

Gulf of Mexico. There is a wave of good news and positive indicators that suggests offshore operators are poised to resume development in 2021-2022, Fig. 3. Offshore acreage has dominated licensing rounds scheduled to close in second-half 2021. Over 35% of the acreage available is in shallow water, while ultra-deep water and deepwater acreage account for 24% and 19%, respectively. Despite the positive leasing activity, World Oil’s survey results and federal officials predict well counts will dwindle slightly during second-half 2021. World Oil forecasts that GOM activity totaled 51 wells in the first half of the year, with another 46 scheduled to be drilled during second-half 2021. The projected 97-well total will be 13% lower than 2020’s figure of 111.

In July, LLOG Exploration announced first production from Praline field, a discovery in Mississippi Canyon Block 74. The Praline well was drilled in 2,600 ft of water to a TD of 13,400 ft and discovered 125 ft of net hydrocarbons. The well was completed in August 2020 and has been tied back to Talos Energy’s Pompano platform. Praline is the first of four tie-back projects the company expects to have online in the next year. BP announced the start-up of the Manuel project, which includes a new subsea production system for two new wells tied into the Na Kika platform. The wells are expected to increase gross platform production by 20,100 boed. Talos Energy successfully drilled the Tornado 3 sidetrack well which encountered 63 ft of net pay in the B6 Upper Zone with rock properties and reservoir consistent with internal modeling and pre-drill expectations. Talos immediately moved to the completion phase. The well is expected to produce 8,000-10,000 boed once online.

STATE-BY-STATE OUTLOOK

Fig. 4. In District 8 of the Permian basin, activity will be up 14% from first-half 2021 to second-half 2021, but the annual total will be down 5%, reflecting operators’ continued restraint on new drilling. Image: ConocoPhillips.

Texas. Most of the shale plays in the Lone Star State will gain ground in 2021. On a half-over-half basis, World Oil predicts Texas wells will gain 22%, with the 2021 total being 4.5% more than the 2020 figure. In the Permian basin (Fig. 4), District 8 will be up 14% in the second half, but its total will be 5.4% less than the 2020 total. Districts 7C and 8A with enjoy improved drilling activity with gains of 22% and 93% respectively, compared to their 2020 totals. The Eagle Ford forecast is mixed, with District 1 up 12% in the second half, but down 8% for the year, compared to the 2020 figure. District 2 will experience a 16% gain in activity in the second half, but will be down 11% on a y-o-y basis. District 4 in the Eagle Ford will experience a 53% increase between the two halves, and post a 135% gain from 2020’s level. The reason that District 4 is surging is more gas-related activity. Other bright spots in Texas are Districts 3, 6 and 7B, all forecast to experience noticeable gains. Again, more gas drilling is a factor, especially in RRC 6, with the Haynesville up 14% y-o-y.

The DUC count in Texas is finally dropping. There are 2,119 DUCS in the Permian and 869 in the Eagle Ford, as of August. These two Texas plays account for 48% of the total U.S. DUC tally of 5,713. Also, the Texas Railroad Commission reported that the statewide flaring rate fell to its lowest rate in years, dropping by approximately 75% since August 2019.

Oklahoma. Although the SCOOP and STACK plays are not as prolific as the Permian or Bakken, acreage in Kingfisher, Canadian, Blaine and Grady counties continues to attract interest for hydrocarbon development. But the region’s inconsistent geology has produced unpredictable results, reducing ROI. However, with higher oil prices, the play has become more attractive, and we predict Oklahoma’s drilling will be up 8%, compared to 2020, with half-on-half activity improving 5%.

Louisiana. In the state’s northern portion, operators developing Haynesville shale gas will drill 15% more wells in 2021 (352), then they did in 2020 (305), with total footage up approximately 18%. With natural gas prices gaining during the year, the increase in activity could continue, similar to the Haynesville play in Texas RRC District 6. In the mature, shallow oil plays of southern Louisiana, activity continues to slow, with footage forecast to decrease 17%, and well spuds dropping 7%, y-o-y. Fig. 5. In North Dakota’s Bakken shale, optimism from higher oil prices is tempered by concern that the sweet spot of the play has reached maximum infill development. Image: ConocoPhillips.

North Dakota. Although transportation issues remain a major challenge in the oil-rich Bakken, a greater concern is that the sweet spot of the play has reached maximum infill development (Fig. 5). However, higher oil prices will help negate the cost of drilling 11,000-21,000-ft laterals. Considering these factors, along with data from state officials and World Oil operator surveys, we forecast that drilling and footage will improve 21% and 18%, respectively, y-o-y, in the Peace Garden State.

In April, Continental Resources announced it will ramp up activity in the Bakken this year, as it shifts more of its production operations to crude oil from natural gas. The company said roughly 70% of its well completions in the second half of the year will be focused on the Bakken versus about 50% of completions at the start of the year. The shift comes as the company is re-orienting its production portfolio to focus more heavily on oil, said CEO Bill Berry during an earnings call.Fig. 6. Northeastern activity, particularly in the Marcellus shale, is on an upward trend, driven by higher natural gas prices. Image: CNX Resources Corporation.

Northeast (Pa./W.V./Ohio). In the Northeast, Marcellus activity is on an upward trend, similar to other U.S. shale plays, Fig. 6. Improving natural gas prices and increased LNG exports from Dominion Energy’s massive Cove Point facility are helping drive activity higher in the region. According to survey results, operators tapping the high-quality reservoir in Pennsylvania will increase the number of wells drilled this year by 35% to 714, compared to 527 drilled in 2020. Total footage for 2021 is forecast to jump 44% also.

In West Virginia, World Oil forecasts operators will drill 180 wells in 2021, the same number as last year. We also forecast no change in total footage (2,520,000 ft). Despite surging gas prices, operators working the shale fields of Appalachia were able to reduce the region’s DUC count by only 17 wells in August on a y-o-y basis, a reduction of just 3%. In Ohio, operators working the Utica play plan to focus on growth and capitalize on higher gas prices, with this year’s total well count expected to finish 43% higher than last year’s level. Footage is forecast to increase 40%.

Rocky Mountains. The Denver Julesburg basin has experienced a constant decline since production peaked in November 2019. Reversing this trend will depend on the capital allocation from major operators in the region. The DJ basin accounted for 7% of oil and 6.6% of natural gas production in the Lower 48 in 2020 (GlobalData). The DJ basin averaged 26 rigs in 2019 and then decreased 65% to an average of nine rigs in 2020. While other U.S. basins have increased their rig count with the rise in commodity prices, DJ has lagged with its rig count and remained at seven rigs since the beginning of the year. Operators, like Oxy and Chevron, are earning better returns from investments in other basins, but could grow production in DJ by completing their DUC backlog.

In Colorado, state officials continue to attempt to ban, or severely limit, drilling in the state. In 2019, the state passed Senate Bill 118, “which fundamentally altered the oil and gas industry’s future in the state,” according to Colorado Governor Jared Polis. However, it appears operators intend to continue operations on existing leases, as World Oil expects companies in Colorado to drill 531 wells in 2021, essentially the same total as in 2020. Total footage is projected to increase 2.5% on a y-o-y basis.

In 2019, a federal judge ordered a halt to exploration on 300,000 acres in Wyoming, saying the government must account for its cumulative effect on climate change. The ruling came in a lawsuit filed by a pair of environmental groups, challenging the BLM’s decision to lease federal lands for energy development in the state. Given that nearly 50% of all lands in Wyoming are owned by the federal government, a ban on federal leasing would decimate the natural gas industry and Wyoming’s economy. Despite the ongoing lawsuit, operators working in the state plan to increase drilling activity by 7.6%, drilling 18 more wells in 2021 than in 2020. World Oil predicts footage will increase 13%.

Acreage in New Mexico has become as desirable as land on the Texas side of Permian basin. Increased completion efficiencies in the Bone Springs formation will help support activity, as drilling in the Land of Enchantment is forecast to hold steady with 945 wells forecast in 2021, and footage will be essentially at 2020’s level.

In California, we expect onshore operators to spud 9.5% fewer wells in 2021, compared to 2020, despite higher oil prices. But with no new discoveries, operators working the Golden State are forced to survive by maintaining less-attractive heavy oil fields and residual acreage from long-ago discoveries. However, considering the mature nature of these fields, onshore footage is forecast to fall just 8%. Drilling offshore California will increase during 2021, with 12 wells expected in 2021, a y-o-y increase of 140%. Footage will increase 218%.

In Alaska, the DOJ filed a brief defending the Willow project, an energy development within the NPRA on Alaska’s North Slope that has been halted by litigation. The Biden administration announced it would review the Willow plan, approved in 2020 by the Trump administration, for consistency. The project, proposed by ConocoPhillips, would provide 100,000 bopd, $10 billion in revenue for state, local and federal governments during its lifespan, 2,000 construction jobs, and 300 permanent jobs. It appears the prospect of opening new acreage is having an effect. Offshore work will surge 600%, with seven wells forecast for 2021, six more than were spudded in 2020. Onshore activity on the North Slope is projected to decrease 21%, with total footage also down 22%.

Others. Activity in the non-core producing states will also enjoy an increase in activity. Drilling will be level on y-o-y basis in Alabama (gas), with gains in Arkansas, Kansas (shallow, vertical oil wells and some gas drilling) and Montana.

Read it from worldoil – Photo as posted on Worldoil (U.S. drilling levels started out 2021 at greatly reduced levels but have improved somewhat since then. Image: APA Corporation.)