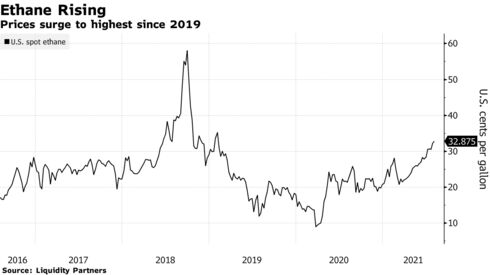

Ethane, a key component in plastic production, is trading at a nearly two-and-a-half-year high in the U.S., with demand surging as global economies recover from last year’s slump.

Prices for the fuel, which is a byproduct of natural gas processing, have climbed 57% this year to 33 cents per gallon Monday in Mont Belvieu, Texas, the main trading hub for natural gas liquids in the U.S. Further stoking the rally is the fact that output of the fuel has stalled alongside oil and natural gas drilling, with drillers continuing to favor capital discipline over output growth.

The higher price of ethane also threatens to drive up plastics prices, adding to widespread concerns about inflation. It comes as companies ranging from Exxon Mobil Corp. and Dow Chemical Inc. spent years investing billions in plastic manufacturing in the U.S. on the assumption that access to low cost ethane as a result of shale gas production would be available for the foreseeable future.

“Gains in ethane feedstock may eventually cause the overall price of plastics to move higher as manufacturers pass along the higher feedstock costs,” says Jason Miner, senior global chemicals analyst at Bloomberg Intelligence. “With strong demand during the pandemic showing plastics remain critical to consumers, a cost-driven boost in prices will likely keep contributing to inflation on store shelves.”

Overseas demand for ethane is also contributing to higher prices in the U.S. Earlier this year, six new very large ethane carriers (VLECs) began shipping the gas to China’s Zhejiang Satellite Petrochemical Co. Ltd. plant under a long-term supply contract with Energy Transfer LP for 52.8 million barrels a year to be shipped from the U.S. Gulf Coast.

Six New VLECs to Supply Ethylene Feedstock in China: BNEF

Some plastic producers have alternatives to ethane. Naphtha is a feedstock tied to crude prices, and depending on where crude is trading relative to natural gas, it can become a more economical choice for plastic-makers that have the flexibility to switch feedstocks.

“If oil goes up faster, the spike in ethane is not a challenge to their investment decisions, but we just don’t know what oil is going to do yet,” Miner said.

U.S. ethane consumption is slated to increase by 30,000 b/d by the end of 2021 and further to 300,000 b/d in 2022, according to the most recent predictions by the Energy Information Administration.

— With assistance by Jeffrey Bair