A significant amount of consolidation has marked virtually every oil and gas recovery cycle for the past two decades. As it relates specifically to the oilfield service market (OFS), this recovery cycle isn’t any different in that regard. However, while historically, the mergers and acquisitions (M&A) activity has mainly been large companies buying smaller companies, this recovery is different.

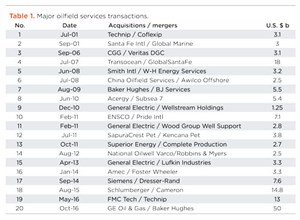

Generally, mergers occur for a few specific reasons—to fill a product gap, generate increased scale or create cost synergies. For example, when Schlumberger acquired Smith Industries in 2010, it was clearly to fill a product gap, as was the case when Schlumberger previously acquired Reed Tool in 1998 and later, Cameron in 2016, Table 1. When General Electric acquired Baker Hughes in 2017 after the Baker Hughes/Halliburton proposed merger collapsed, it was to achieve increased scale while also filling product gaps. The TechnipFMC merger of 2017 was a combination of complementary product lines, dramatically changing that company’s scale. TechnipFMC divided itself into two companies—Technip FMC and Technip Energies—and the latter focused on upstream activities.

Emerging trends in M&A activity. While scale is important—maybe more now than ever—this recovery is finding mergers occurring between smaller companies to achieve adequate scale, versus merely large companies merging to achieve very large scale or large companies making “tuck-in” acquisitions to fill product or geographic gaps. Private equity funding is focused on these smaller mergers between regional companies for a wide range of reasons, not the least of which appears to be a lack of appetite in the public markets for large-scale consolidation. More focused private funding is more available, as regional service companies find funds to expand a given service line, or more focused vertical integration to provide more services to their customers.

Meanwhile, Covid-19 presented its own set of challenges, dramatically impacting the short-term demand for oil and gas products and services. While businesses across several industries faced a challenging 2020 following the spread of Covid-19 and subsequent decline in economic activity, the oil and gas industry has been one of the most negatively impacted by the pandemic, with energy industry revenues declining 54%, according to Deloitte. There were only 258 deals across the sector in 2020, the lowest number in more than a decade, Fig. 1. Deal value fell below $30 billion during the first half of the year—also the lowest in the decade—but rebounded to almost $170 billion in the second half.Fig. 1. In 2020, Covid-19 drove OFS M&As to their lowest level in 10 years.

According to Deloitte, the impact was felt across all segments, with oilfield services (OFS) being hit the hardest. Though market fundamentals have improved rapidly since May lows, the recovery has been uneven. Fuel demand, commodity prices and, therefore, oil and gas activity will likely not recover fully until broader economic activity returns to pre–Covid-19 levels. However, based on recent vaccine announcements, Deloitte presented a fourth-quarter U.S. economic forecast that the country could begin to normalize through 2021 as retail, restaurant and industrial activity bounces back, though uncertainty remains, depending on whether there is continued economic relief.

According to industry experts, new sources of capital are needed, or the industry may need to rethink how it finances, both organic and inorganic growth. Since 2016, equity issuance, IPOs, venture capital and private equity investments have dropped significantly, often replaced with debt. Oil and gas sector debt issuance has continued to rise, spiking to more than $240 billion in 2020, $98 billion of which was in the second quarter alone. Companies will need to boost performance, compared with other sectors, to attract other traditional sources of capital, as well as find other, less traditional sources to support growth post-2020. The biggest negative associated with debt financing is the risk that revenues do not cover the cost of the debt, driving the company into possible bankruptcy.

Effects of downturn not equally distributed. Due to the significant differences between the operations of the OFS industry participants, an industry downturn doesn’t impact all OFS participants to the same degree, Fig. 2. For instance, OFS businesses that disproportionately serve the natural gas side of the industry were not impacted as significantly by the precipitous drop in oil prices during second-quarter 2020. In the same way, OFS participants may be impacted differently, based on the E&P sub-sector they serve. For example, during the 2020 oil price disruption, new drilling operations were adversely affected much more than were continuing production operations. Following a sharp decline in oil prices, exploration efforts may be curtailed much more than production operations.Fig. 2. OFS products and services segmentation.

For example, when oil prices are in the $35-to-$40/bbl range, it can be economically beneficial to continue production from existing wells, but quite economically unviable to incur the cost of drilling new wells. And, it can be even much less economical to incur exploration-related expenses. As such, OFS companies, whose services support production activities, i.e., fracing, well maintenance services and production chemical providers, face less severe circumstances at $35-to-$40/bbl prices than OFS companies that support exploration activities, including geological, seismic, drilling and site preparation services.

The fluids management sector has been hit especially hard by the need to participate in mergers and divestitures, as this service line is susceptible to pricing pressure. Select Energy merging with Rockwater, who themselves executed many acquisitions, is a case in point. This 2017 merger came on the heels of the oil price collapse in 2016. Consequently, Select continued its acquisition binge, acquiring Pro Testing in fourth-quarter 2018 and Baker Well Services in third-quarter 2019.

However, cost pressure is being experienced across all segments. To some extent, these mergers—particularly between smaller companies—are a matter of competitive positioning and survival. Between political pressure to transition away from oil and gas (not likely anytime soon) and reduced demand, due to the pandemic, merging is often the best path for smaller companies to thrive going forward. However, this confluence of events creates great opportunities for cost synergies among smaller companies for many private equity firms.

Oil price. Of course, there is a direct relationship between dramatic changes in the price of oil and the rise in mergers, acquisitions and divestitures within the oilfield services sector, Fig. 3. During periods of downward price pressure, companies merge to gain cost synergies, while during periods of price increases, mergers occur to quickly gain scale and increased market share. The steep drop in oil prices in 2020 from $60-plus, down to $20, represented the most significant decline in the shortest time in modern history. Even when the price dropped from $160/bbl to $60/bbl in 2008, the price slide took place over a more extended period and found its floor at a level where profits were still possible. But, in 2020, when prices dropped to $20 (and below), profits were more difficult to achieve.Fig. 3. Oil price volatility changes the nature of M&A activity.

Rig count. The other leading indicator of the need for mergers, acquisitions and divestitures in the oil field is the rig count, Fig. 4. With rig count at all-time lows, there are too many service companies pursuing the possible services business. From a high of nearly 1,600 operating rigs in the U.S. during mid-2015, to a low of approximately 200 rigs operating in mid-2020, it’s obvious why there is accelerating consolidation within the oilfield service sector.Fig. 4. U.S. rig count hit an all-time low in 2020, forcing OFS companies to consolidate to survive the catastrophic bust cycle.

The reason to comment on this cyclical trend at this point in mid-2021 is that rig count has been trending steadily upward after such a dramatic drop in 2020. This is good news, as M&A activity can refocus on growth and the value of scale at both the high end and the mid-market categories of the oilfield service sector. One of the indications of this repositioning of OFS companies was in the fall of 2020, when Liberty Oilfield Services bought Schlumberger’s North American fracing operations for $430 million. At the same time, Schlumberger invested in Liberty, demonstrating its increased confidence in the North American OFS business. This deal was an early indication of deals to come, as the recovery in the OFS sector was emerging.

M&A at any cost. Meanwhile, the emergence of “blank check” OFS companies has also created a market for OFS mergers. National Energy Services Reunited’s (NESR’s) acquisition of Gulf Energy SAOC and National Petroleum Services in the fall of 2017 also has created a category of next-generation, well-financed OFS companies. Former Schlumberger CEO Andrew Gould’s Sentinel Energy Services, formed in late 2017, is poised to make a major impact, as well. The first installment of this effort resulted in Sentinel’s late 2018 definitive agreement to acquire a majority interest in Strike Capital LLC, which owns and operates the North American infrastructure and integrity services and projects business, Strike LLC, in a deal valued at $854 million. According to EY, more consolidation is expected at the top end of the market, as large companies continue to consolidate, due to their competitors’ consolidations to protect market share, retain leadership positions in key markets, and protect their operational leverage.

Perhaps anticipating downward pressure on oil prices, C&J and Keane merged in the fall of 2019 to form NexTier, creating a leading well completion and production services company. Then, to focus their efforts, NexTier sold their production operations business to Basic Energy Services in 2020. Further streamlining of OFS company service lines is expected, as OFS companies are preparing for increased volatility in prices and demand.

Private equity firms are also entering the fray, as Argonaut Private Energy acquired BJ Services cementing business in late 2020 and rebranding it American Cementing, while also acquiring Pioneer’s Well Service business, combining it with Nichols Oil Tools and rebranding it American Well Services in March 2021. Meanwhile, Edge OFS recently acquired Gladiator, Ideal, PCS and Reliance to form a set of complementary services for their customers. In the public markets, Ranger Energy Services acquired Patriot Well Services in May 2021 to fortify their wireline service business in North American basins. In addition, Archer acquired Deepwell in May of 2021 to strengthen their wireline and downhole services in Norway.

M&A forecast. The current environment is ripe for more mergers, acquisitions and divestitures, as rising rig count, and improving oil and natural gas prices, are creating a situation where demand for OFS services could challenge the supply of those services. OFS companies downsized dramatically in 2020 to reflect the dramatic decline in demand for oil and natural gas, due to the pandemic. However, with increased demand, mergers and acquisitions are expected to accelerate during second-half 2021. Essentially, the OFS sector is reformulating itself to reflect the current demand/supply equation, and M&A is often the quickest, most cost-effective way to do so.

Which segments will see the most significant consolidation? Will there be more M&A activity at the high end of the market or within the mid-market? Will E&P companies determine that it is more cost-effective to own a full-service OFS company? Will international companies merge with North American companies to gain global scale? Who will supply the funding for M&A activity, i.e., debt, stock, PE firms? Will M&A activity be basin-specific within the mid-market? Will “blank check” companies continue to enter the market? Which segments/service lines are riper than others for M&A activity? How high will oil and natural gas prices rise in 2021 and how long before demand reaches and/or exceeds pre-pandemic levels? How high will rig count rise in 2021? The answers to these questions will likely drive the pace of M&A activity within the OFS sector in 2021 and beyond. But every recovery has seen significant M&A activity and this recovery, as evidenced by all the recent activity, seems to be following suit.

Read it from worldoil – Photo by Anna Nekrashevich from Pexels