The oil industry took a tumble in 2020, but the tides are beginning to turn.

Oil prices are currently wading cautiously in the $50 range as a new wave of lockdowns has brought the Western world to another standstill. Despite this, however, demand for oil in Asia is returning to pre-pandemic levels and the market is loving it.

In addition to crude prices slowly recovering, oil companies are also feeling the bump.

Supermajors like Exxon and Shell are up over X% since the start of the trading year…And this rally is just getting started.

The biggest movers in the industry, however, aren’t yet making headlines…In fact, many are still flying under most investors’ radars.

But one company, in particular, may be set to outperform...in a big way.

is a small company that has secured the oil and gas rights to an entire sedimentary basin in Namibia and Botswana–both very friendly to oil exploration, with very low royalty fees (5%) and prospects for discovering an estimated 120 billion barrels of oil (yes, 120 billion).

Now, three important things have just happened …

First, RECO’s just about to start drilling in what could end up being the next big onshore oil discovery in the world. So, this is the last train out of the station and the final destination could send this stock to heights that few junior stocks ever get to go.

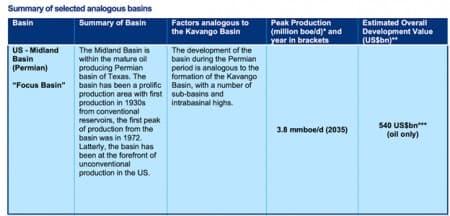

Second, the biggest and most trusted name in natural resource assessments–Wood Mackenzie–has just released a report comparing RECO’s Kavango basin to the Midland Basin in Texas, and Wood Mackenzie believes the Midland has a development value of $540 billion.

Third, Haywood has just nearly doubled its short-term share price target from $2.50 to $4.00 …

And both Wood MacKenzie and Haywood have a great deal of insight to share on this opportunity, which we will get into in more detail below.

Here’s what Wood Mackenzie has to say in its latest report:

There’s no one more respected in the resource space than Wood Mackenzie. So, when they came out with this report, our excitement level increased exponentially.

Wood Mackenzie detailed three world-class similar age basins–the Midland Basin in Texas, the Southern North Sea Basin in the Netherlands and the UK, and the Doba Basin in Chad (Africa)–and demonstrated how RECO’s Kavango is analogous to all three, but particularly to the giant Midland Basin.

Why is this so exciting?

Because the Midland Basin, in the Permian basin of Texas, has been producing oil since the 1930s, and it is the undisputed king of American production. It won’t even hit peak production until 2035 at 3.8 million barrels of oil equivalent per day. And it’s estimated overall development value is $540 billion (in oil only). We are all familiar with Permian Basin as an unconventional resource, but that’s only over the last decade. This basin, like all other super basins, produced from low-cost conventional reservoirs for most of its history, since the 1930’s!

The Kavango Basin was formed at the same geologic time–during the early Permian period, and Recon Africa (TSXV:RECO, OTC:RECAF) is logically focused on conventional oil and gas; no fracking, low water needs and overall low cost per BOE. This model is economically resilient at any current oil price model.

All of this makes world-renowned geochemist Dan Jarvie’s conservative estimates that Kavango could generate 100+ Billion barrels of oil all the more reasonable.

Haywood has seen it, too. That’s why they’ve just boosted their short-term price target from $2.50 to $4.00.

Less than a month ago, Haywood initiated coverage and put a short-term $2.50 price on RECO, saying the company was “set and funded to de-risk a potentially material resource play onshore Namibia and Botswana with 1,348 mmbbls/58.1 Tcf best estimate prospective recoverable resource (gross).”

At that time, Haywood recommended “accumulating a position ahead of drilling/evaluation news flow in H1/21 aimed at proving up the presence of a working hydrocarbons system, which if confirmed, should provide abundant opportunities for further exploration and appraisal drilling”.

“On a successful discovery, attractive fiscal terms should help to facilitate the development of the basin, thereby increasing the chance of commercialization and shareholder value”.

The first time around, Haywood emphasized that noted source rock expert Dan Jarvie estimated RECO’s Kavango Basin was capable of generating over 100 billion barrels of oil. And in Haywood’s opinion, given the scale of the basin (we’re talking about 6.3MM acres in Namibia plus an additional 2.2MM in Botswana), a discovery success would present manifold opportunities for strategic joint ventures for further de-risking–without shareholder dilution.

If Haywood thought “this could be big” in early November, by late December it was even more convinced when RECO spudded its first high-impact 6-2 exploration well, prompting the $4.00 price target.

This is the first of three planned exploration wells to evaluate the presences of an active conventional system in the Kavango Basin, with Haywood noting: “While geochemcial work and other studies have estimated that the basin could hold significant in-place oil volumes, exploration is required to fully determine if this is the case, and RECO is now one step closer to de-risking a massive potential resource.”

Each phase of de-risking for this tiny company sitting on the kind of basin usually reserved for supermajors makes the stock price soar–and if it hits Haywood’s targets, it will nearly double right off the bat–or the bit.

Haywood’s seen it happen before with exploration plays only a fraction of this size that netted investors in junior companies big returns.

In terms of valuation, then, Haywood sees material upside here as Kavango is de-risked:

This is a huge risk-reward equation, so it’s not for the faint of heart. But even Haywood sees the potential rewards outweighing the risks in its price targets.

And there are plenty of catalysts that could bump this even further very quickly.

With the first high-impact well already spudded, and drilling operations now underway as of today, by mid-February, we could already see them reach a depth of 12,000 feet. Next comes 2D seismic acquisition and interpretation in Q1 2021, followed by 6-2 well evaluation and drilling of two other back-to-back wells in the same quarter. By the second half of next year, it’s likely RECO will already be in JV discussions if drilling goes as planned.

This is now prime time for Recon Africa (TSXV:RECO, OTC:RECAF), so it could be now or never for the biggest potential rewards. We are dying to see the results of their first drill in a matter of weeks because that’s when the biggest excitement is generated if the news is positive. It doesn’t get much more speculative than this. But it also doesn’t get potentially bigger than this, either. That’s the risk/reward equation.

Other companies looking to capitalize on the 2021 rebound in oil:

BP (NYSE:BP) is a European energy giant with a massive presence in the industry. Like the rest of the heavily oil-focused supermajors, BP felt the full weight of the oil price collapse earlier this year and is still struggling to find its feet in the COVID-stricken marketplace. Despite this, however, BP’s renewable plans, in addition to its strong management decisions, put the company in a positive place going forward. Not to mention, it’s still paying dividends. While the oil giant may be down, it’s certainly not yet out for the count.

BP has been criticized in the past for being slow or late to the environmental cause, but it could now leapfrog its peers. We are still a long way from Beyond Petroleum. But chief executive Bernard Looney believes that we are only 30 years from a net-zero BP. He has promised that in September the company will lay out a more detailed plan that shows the path to that destination. But he has shown already that there is more to his commitment to net-zero than there was to Beyond Petroleum 20 years ago.

“Renewables and natural gas together account for the great majority of the growth in primary energy. In our evolving transition scenario, 85% of new energy is lower carbon,” Spencer Dale, BP group chief economist, said, commenting on the outlook to 2040.

Royal Dutch Shell (NYSE:RDS.A) is another giant that took a beating this year, but it has slowly seen its price recover since March lows. After falling from a year-start of $60, it fell all the way to $25. Since then, however, it has seen positive gains, climbing by over 40% to today’s price of $35. While it’s still down on the year, positive sentiment is growing for Shell and other oil majors.

Shell’s big bets on Africa could start showing some payoff this year. It has been in the African oil game for ages. In fact, the Dutch oil giant began drilling in the region over 70 years ago. While it has sold off a number of assets in the region in recent years, it continues to maintain a strong presence, particularly in South Africa.

Shell’s South African assets are important because the government has been significantly more stable than some of the other major plays on the continent. Moreover, it’s been very supportive of Shell in its endeavors in the country. Its operations in South Africa include retail and commercial fuel, lubricant, chemical and manufacturing. It’s also heavily invested in upstream exploration. It even holds the exploration rights to the Orange Basin Deep Water area, off the country’s west coast and has applications for shale gas exploration rights in the Karoo, in central South Africa. The Dutch oil major isn’t overlooking Namibia, either.

“Namibia is one of the places where the geology is very interesting,” Shell Upstream’s VP of exploration for the Middle East and Africa, Colette Hirstius, recently told an African oil conference in Cape Town. “We recently acquired seismic data and are continuing to be encouraged by what we see,” she added.

Though Canadian oil has had a particularly rough go at it this year, Canadian Natural Resources (NYSE:CNQ; TSX:CNQ), kept its dividend intact after swinging to a loss for the first half of the year, while Canada’s producers are scaling back production by around 1 million bpd amid low oil prices and demand. Though Canadian Natural Resources kept its dividend, it withdrew its production guidance for 2020, however. It also said it would curtail some production at high-cost conventional projects in North America and oil sands operations and carry out planned turnaround activities at oil sands projects in the second half of 2020.

Despite the negative stigma surrounding the the oil sands, the sector is starting to clean up its act a bit. And Canadian Natural Resources is leading the charge. And if analysts are right about Canada’s comeback, Canadian Natural Resources could be in for a big year.

While the Canadian energy giant has seen its stock price slump last year, it could provide a potentially opportunity for investors as oil prices rebound. It is already up over 170% from its March lows, and it could still have some more room to run.

Suncor Energy (NYSE:SU, TSX:SU) is another major player in the Canadian oil scene. And it’s carving out a particularly interesting niche for itself. Suncor has pioneered a number of high-tech solutions for finding, pumping, storing, and delivering its resources. Not only is it big in the oil sector, however, it is a leader in renewable energy. Recently, the company invested $300 million in a wind farm located in Alberta.

When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production – those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

Better still, some analysts are already turning a bit more bullish on the oil sands, which is great news for Suncor.

“With improved cost structures and increased propensity to be capital disciplined, Canadian producers are emerging from the downturn stronger, with greater ability to generate free cash flow,” Morgan Stanley analysts Benny Wong and Adam J Gray

Total (NYSE:TOT) is a giant in the energy game. The French oil major has a major reach across practically every energy-related sector. From oil and gas to renewables and beyond. And thanks to its diversification, it has outperformed other pure oil majors. It is not only acutely aware of the needs that are not being met by a significant portion of the world’s growing population, it is also staying ahead of the looming climate crisis by boosting its renewable assets. From diversity and societal progression and workplace safety to its commitment to reducing its own carbon footprint, the near-100 year old energy giant is checking all the right boxes for investors.

As such, Total is not only betting big on renewable energy, it is also doing its part in reducing emissions in its day-to-day activities. Patrick Pouyanné, Chairman and Chief Executive Officer at Total noted, “It’s our job to meet growing energy needs while reducing carbon emissions.”

While Total’s share price slipped in March along with the wider market, Total’s pivot towards sustainability has helped it outperform some of its peers. Though it still maintains a major presence in the global oil and gas industry, it has made significant strides in the renewable realm, as well.

By. James Stafford

Note: This is an opinion piece and was sent to subscribers of Oilprice earlier today.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements. Statements contained in this document that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of Recon. All estimates and statements with respect to Recon’s operations, its plans and projections, size of potential oil reserves, comparisons to other oil producing fields, oil prices, recoverable oil, production targets, production and other operating costs and likelihood of oil recoverability are forward-looking statements under applicable securities laws and necessarily involve risks and uncertainties including, without limitation: risks associated with oil and gas exploration, timing of reports, development, exploitation and production, geological risks, marketing and transportation, availability of adequate funding, volatility of commodity prices, imprecision of reserve and resource estimates, environmental risks, competition from other producers, government regulation, dates of commencement of production and changes in the regulatory and taxation environment. Actual results may vary materially from the information provided in this document, and there is no representation that the actual results realized in the future will be the same in whole or in part as those presented herein. Other factors that could cause actual results to differ from those contained in the forward-looking statements are also set forth in filings that Recon and its technical analysts have made, We undertake no obligation, except as otherwise required by law, to update these forward-looking statements except as required by law.

Exploration for hydrocarbons is a speculative venture necessarily involving substantial risk. Recon’s future success will depend on its ability to develop its current properties and on its ability to discover resources that are capable of commercial production. However, there is no assurance that Recon’s future exploration and development efforts will result in the discovery or development of commercial accumulations of oil and natural gas. In addition, even if hydrocarbons are discovered, the costs of extracting and delivering the hydrocarbons to market and variations in the market price may render uneconomic any discovered deposit. Geological conditions are variable and unpredictable. Even if production is commenced from a well, the quantity of hydrocarbons produced inevitably will decline over time, and production may be adversely affected or may have to be terminated altogether if Recon encounters unforeseen geological conditions. Adverse climatic conditions at such properties may also hinder Recon’s ability to carry on exploration or production activities continuously throughout any given year.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) is being paid by Recon seventy thousand U.S. dollars per article to write and disseminate various articles, but is not being specifically paid for this editorial. As the Company is being paid for articles, there is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:RECO. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

Read it from oilprice – photo as posted on Oilprice