Natural gas prices today are trading at $5.287/MMBtu, but if you look at the curve, prices down the road are nowhere near today’s level.

Source: CME

The futures curve has never been a great predictor for future prices because of the imbalance in buyers and sellers. Seasonality also plays an important role in natural gas with winter gas months always at a premium to summer months.

But in this case, the skyrocketing prompt month is reflecting one uncomfortable truth – there’s no supply increase in the near term to save the market.

And without the much-needed supply increase, the world is at the whim of mother nature which tends to be extremely volatile and unpredictable. But the bigger looming question down the road is: Will elevated prices today lead to higher gas production down the road?

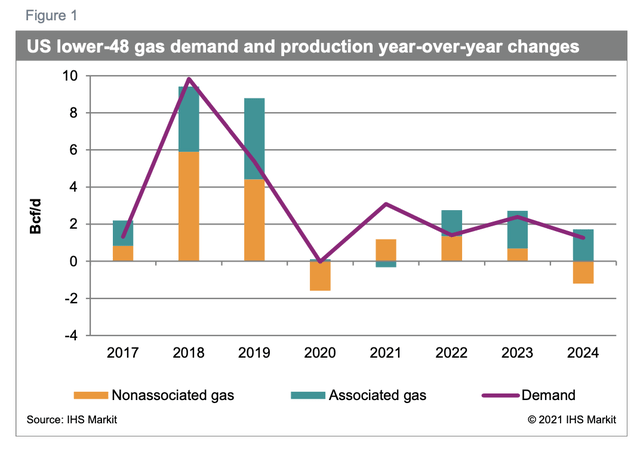

In its latest market insight report, IHS notes that production growth should roar back in 2022.

IHS notes that the production growth could yield +3 Bcf/d from Dec 2021 to Dec 2022. The increased production will come primarily from Haynesville and US shale oil.

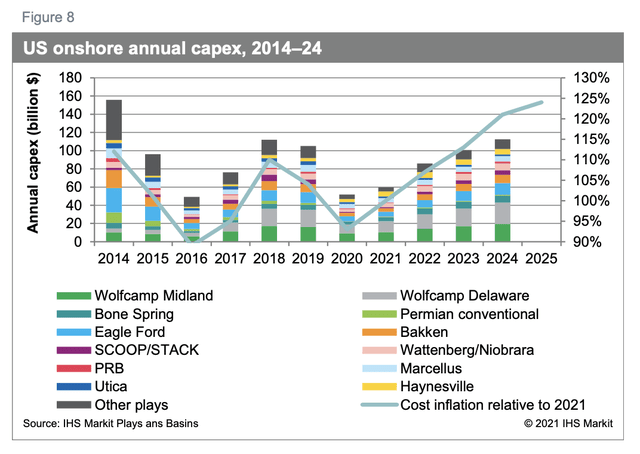

The sensitivity of IHS’s outlook will be dependent on the US shale capex outlook for 2022.

At the moment, IHS is expecting a 40% increase in capex in 2022. But even IHS notes that the new capex disciplined culture could throw this outlook out the window.

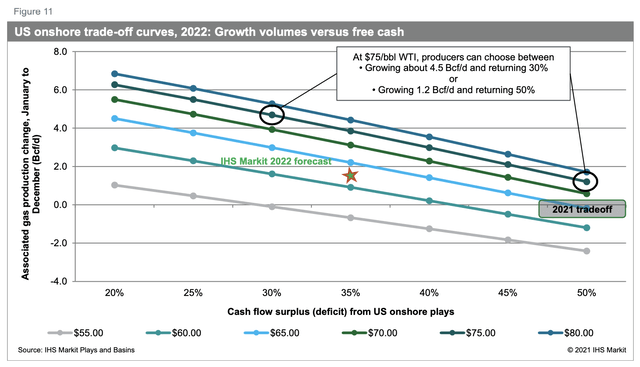

For example, in this sensitivity chart above, IHS is assuming that US shale producers only return ~35% of excess free cash flow back to shareholders. And it notes that if producers return ~50%, the growth falls to 1.2 Bcf/d.

This is where we diverge materially from IHS.

Based on all the discussions we’ve had with management teams over the last several months, capex will not increase by ~40%. Including cost inflation, we are expecting a ~20% bump in capex to 1) offset decline and 2) offer 2-5% modest production growth.

If current commodity prices persist, companies will likely issue 1) a variable dividend, 2) a share buyback plan, and 3) a low base dividend. As a result, we believe IHS is miscalculating the potential of even higher shareholder returns in the face of higher commodity prices.

We think with LNG demand growth expected again next year to the tune of ~1.5 Bcf/d, the production growth will offset that, leaving the market still slightly undersupplied.

And so long as capital discipline continues, it’s going to be hard to argue an oversupply situation.

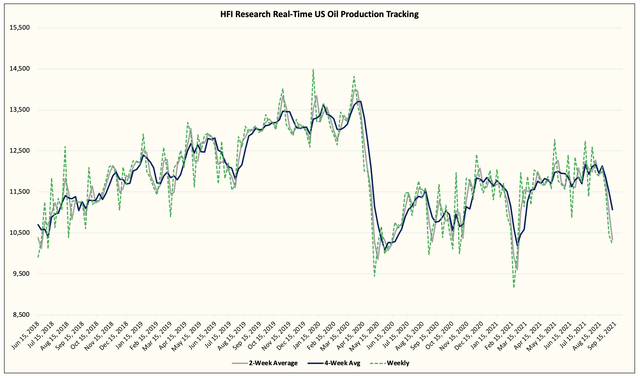

On the US shale oil front, our real-time production tracking indicator is showing flat oil production growth from May/June levels.

Source: HFI Research

Note that the above chart includes Gulf of Mexico production outage. Adding the lost barrels back (~1.8 mb/d), we get to about the same baseline as May/June.

As a result, it’s evident on both the US shale oil and shale gas front that production discipline is likely here to stay. Investors should expect more and more companies to announce 1) even higher dividends and 2) higher share buyback programs.

With the supply drop and structural increase in natural gas exports, natural gas investors and traders may be staring at a potential multi-year bull market developing in the natural gas space. Now is the time to really start looking at some of the natural gas producers that will benefit greatly from a price uplift. At HFI Research Natural Gas, we are the #1 natural gas service and we can help you navigate through what’s coming.

Read it from seeking alpha