Chevron has a major decision to make after Anadarko Petroleum decided to ditch a $33 billion deal with the oil major and instead sell its business to Occidental Petroleum.

Anadarko’s board said Monday a revised $38 billion offer from Occidental was superior to its existing $33 billion agreement with Chevron. Now, Chevron has until Friday to counter Occidental’s bid for Anadarko, an international driller with enviable assets in U.S. shale fields, the Gulf of Mexico and Africa.

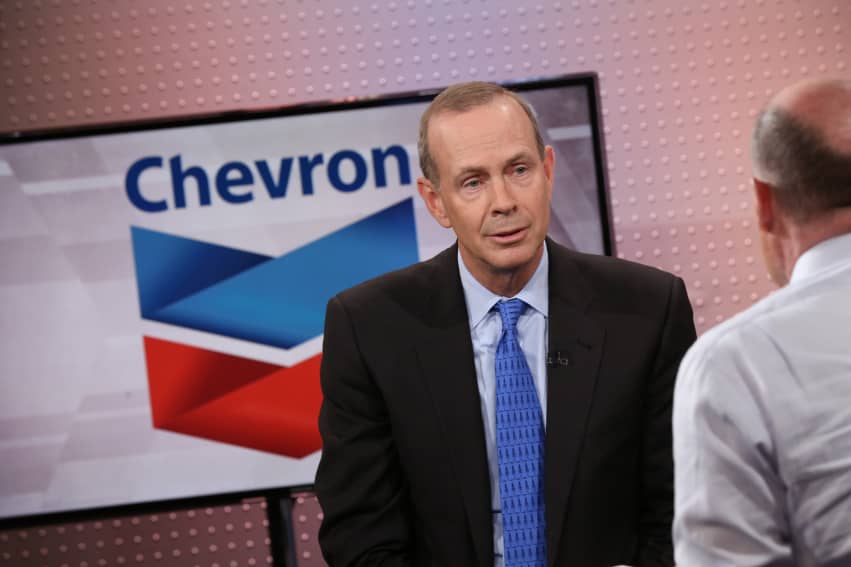

There’s no doubt the San Ramon, California-based energy giant can afford to put more chips on the table. But Chevron CEO Michael Wirth told analysts last month he won’t overpay. He said his company has a strong case to present to investors whether or not he closes the deal with Anadarko.

The question is whether it makes more sense for Chevron to fold and pocket a $1 billion breakup fee. At least one investment bank thinks the drama is over.

Stifel believes Chevron will walk away from the deal and look for another acquisition target in the Permian Basin, the top U.S. shale field underlying Texas and New Mexico. Chevron also wanted Anadarko’s liquefied natural gas development in Mozambique, but not badly enough to put up a fight, according to Stifel analyst Michael Scialla.

“While CVX had overlap with APC’s Permian assets and could easily manage the Mozambique project, the company is unlikely to stretch for this transaction, in our view, as long as cheaper alternatives … are available,” Scialla said in a research note Monday.

According to Scialla, options include Concho Resources, Parsley Energy, Pioneer Natural Resources and Cimarex Energy.

KeyBanc analyst Leo Mariani thinks Chevron will make at least one counteroffer, probably bidding at least $70 per share. At that price, Chevron would tack another $3.2 billion onto its overall proposal, he says.

Chevron also has a built-in $2.50 per share advantage because Anadarko would not have to pay the $1 billion breakup fee, Mariani notes. In his view, Chevron also has more currency because it would emerge from the deal with less debt than Occidental.

Still, the $70 per share offer might not be enough to beat Occidental’s $76 per share bid, Mariani says.}

Mizuho Securities also anticipates a counteroffer because “Chevron has some major structural reasons to want Anadarko.” That would cause Occidental to raise its own bid, but from there, thinks things could get interesting, according to Mizuho’s lead oil analyst, Paul Sankey.

Occidental is mostly focused on Anadarko’s Permian assets, while Chevron has its eye on a bigger part of the portfolio. Sankey speculates that Chevron could waive the $1 billion breakup fee in exchange for a major asset swap with Occidental.

Most investors expect Chevron to put in just one more bid — and one that matches Occidental’s offer to pay 78% cash and 22% stock for Anadarko, says Morgan Stanley. The Chevron-Anadarko transaction is structured as a 25% cash and 75% stock deal.

Once Chevron puts in its bid, Morgan Stanley thinks Occidental his limited room to maneuver. Raising its bid much further would raise concerns that it is taking on too much borrowed capital.

Photo as posted on CNBC – Michael Wirth, CEO of Chevron. Adam Jeffery | CNBC