Drillers in the Eagle Ford Shale were productive in 2018, but as oil prices hover around $50 a barrel, there will likely be a halt on new wells in 2019, experts say.

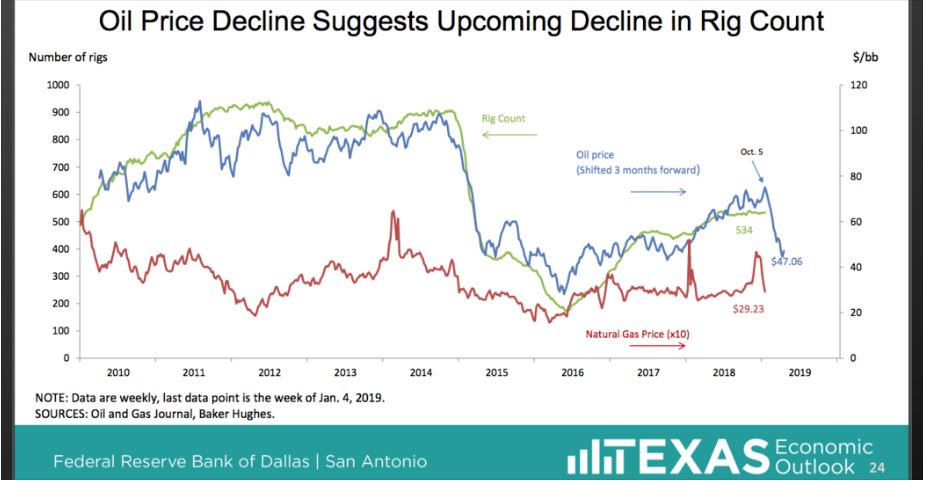

There were 175 more new well applications submitted in 2018 in the counties that encompass the Eagle Ford Shale than in 2017, according to data released by the Railroad Commission of Texas last week. In a presentation before market watchers in San Antonio on this week, Federal Reserve Bank of Dallas economist Keith Phillipssaid the rig counts in that region and in the Permian Basin are likely to fall in the coming year.

The Eagle Ford was slow to recover from the last downturn in oil prices in 2015 and 2016, Phillips said. Production began picking up in 2017 and increased in 2018 as prices climbed to $75 per barrel. The price drop in late December, however, has likely significantly slowed it into second quarter 2019.

“I expect drilling in the Eagle Ford to kind of stay at the somewhat elevated level it is at for three or four months and then maybe start to drop off somewhat after that,” Phillips said.

Thomas Tunstall, a senior researcher with the University of Texas San Antonio’s Institute of Economic Development, told the San Antonio Business Journal that prices are starting to edge up from a $45-per-barrel low around Christmas, largely due to Saudi Arabia’s decision to cut production.

But the price is still not at the level necessary for many companies, especially smaller companies, to be incentivized to increase production, Tunstall said.

The “happy price” for oil is around $60 per barrel, he said, which is “high enough to make a profit but not so high as to freak people out at the gas pump.” However, “it’s going to vary company by company,” he said, noting that behemoths like Houston-based EOG Resources Inc. (NYSE: EOG) have the capacity to make a profit at a much lower price.

“EOG has some of the choicest leases in the Eagle Ford,” Tunstall said. “They have indicated publicly that they can make money at $30 per barrel.”

Whether or not prices climb is going to be largely dependent on Saudi Arabia, Russia and other oil producing countries, as well as whether China’s economy continues to flounder, Tunstall said. China is the world’s largest importer of oil but its economy has been struggling lately.

Still, even if everything else remains negative, technology could save production in the shale, said Chris Ashcroft, president of the South Texas Energy and Economic Round Table. Ashcroft said new technology is enabling producers to pump more oil from a single well, decreasing the need to drill more wells to keep production levels up.

“I think you’ll continue to see production remain steady or grow, and I think you’ll continue to see the U.S. as the number one producer of crude oil in the world,” Ashcroft said.