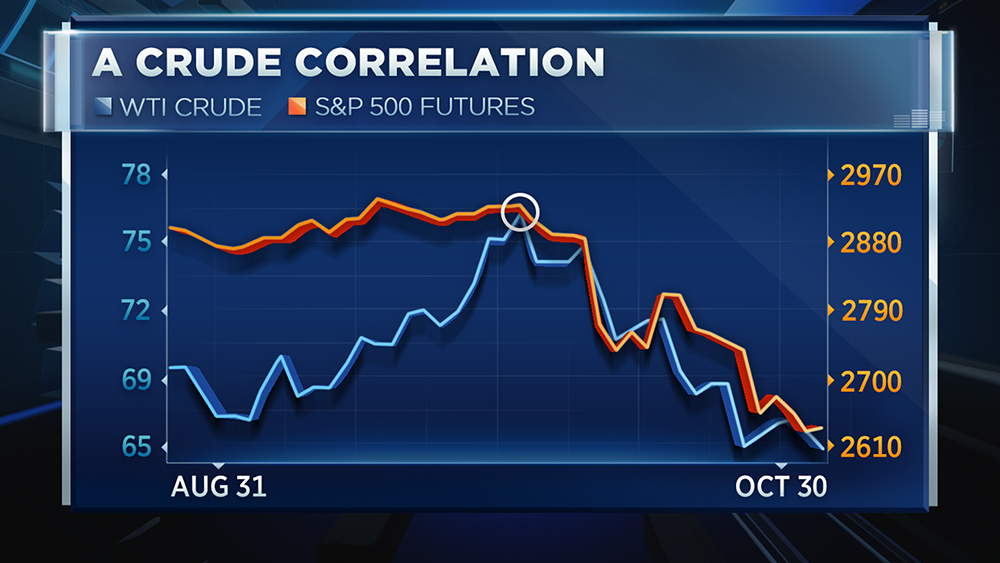

Energy expert John Kilduff sees an unusual phenomenon affecting crude oil and beaten-down stocks.

According to the Again Capital founding partner, oil and stocks have embarked on the closest trading relationship since early 2016 and during the financial crisis sell-off.

“This has been the highest correlation that I’ve seen in quite some time,” he said Tuesday on CNBC’s “Futures Now.”

His latest thoughts came with U.S. benchmark West Texas Intermediate crude on track for its worst month in more than two years. WTI closed at $66.40 a barrel on Tuesday, while Brent crude settled at $76.23.

“A lot of folks like to trade crude oil and other commodities to get away from the correlations you have in the stock market,” said Kilduff, a CNBC contributor. “But over the past 20 days, you can see where stocks peak out in early October. Crude oil peaked out in early October.”

He suggests that fears of a global economic slowdown could be behind the rare move.

“It’s a real risk off, and the same things that are bedeviling the equity market are bedeviling the crude market,” he said.

However, Kilduff isn’t implying the trend spells more downside ahead. There’s a bullish factor hanging over the oil market: Iran.

On Sunday, sanctions against Iran exports are scheduled to go back into effect. And, it’s unclear how they’ll impact oil prices.

“We’ll know in a relatively short amount of time whether the sanctions on Iran are really going to bite or not. I think they are to a degree,” he said.

Taking that into account, Kilduff believes crude could break out of its slump within weeks and rally from current levels.

“I do see a nice rebound for crude oil as we get into the very end of the year, and the heart of the Northern Hemisphere winter of about $75-plus for crude WTI,” Kilduff said.