The Baker Hughes rig count, a metric tracking oil production in North America since 1944, is sky-high this week at 993 rigs as of Thursday, an increase of 169 rigs year-over-year. As oil and gas production builds, particularly in trucking-intensive shale plays, flatbed spot rates for lanes associated with the petroleum industry continue to gain momentum.

FreightWaves Director of Data Science Sam Tibbs has estimated that every additional rig is associated with an increase of 1.1M truckload miles.

We used DAT’s Rateview tool to look at flatbed lanes connecting three kinds of locations: flatbed trucking hubs in Birmingham and Montgomery, Alabama, and Nashville, Tennessee; refinery centers in Houston and New Orleans; and shale plays like the Permian Basin in West Texas (Lubbock) and the SCOOP/STACK shale fields in central Oklahoma (Oklahoma City).

The most dramatic spike in flatbed spot rates we found was on the Houston to Oklahoma City lane, which is averaging $3.08 over the past seven days, up from an average of $2.58 in February. The lane from Birmingham, Alabama, where P&S Transportation, one of the largest flatbed carriers in the country is based, to Oklahoma City has also been running hot at $2.97 over the past seven days, up from $2.21 in January and $2.72 in February.

Flatbed traffic to and from cities like Houston, New Orleans, and Dallas, which supply the oil and gas industry with financing, personnel, and equipment, has also been trending up. Flatbed rates from New Orleans to Houston averaged $2.87 over the past seven days, rising steadily from $2.64 in November. The lane from Montgomery to Houston posted an average of $2.74 over the past seven days, up from $2.41 in February. Montgomery to Dallas was running steadily at $2.57 over the past seven days, up slightly from $2.48 in February. Flatbed truck rates from Nashville, where Daseke-owned TSH & Co. is based, to Houston jumped up to $2.67 over the past seven days, from $2.28 in February.

Finally, the heavily-trafficked lane from Houston to the Lubbock market in west Texas, which we used as a proxy for the Permian Basin, was averaging $2.97 over the past seven days, still climbing from its February average at $2.71.

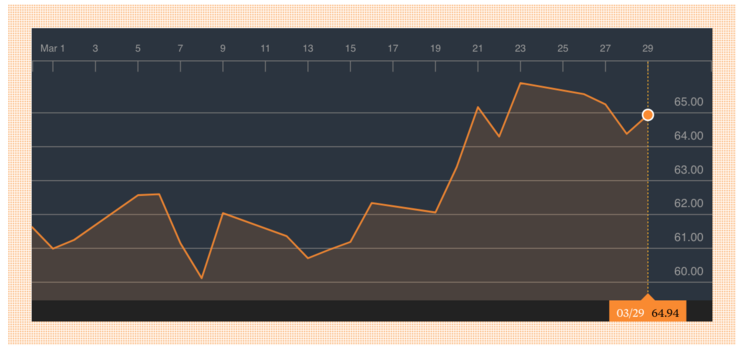

FreightWaves expects trucking-intensive shale oil production to stay strong as long as prices for West Texas Intermediate (WTI) crude remain high. The Federal Reserve Bank of Dallas conducted a survey of 136 shale companies and found that more than half of them intend to hire more people this year, and that the average break-even point for the respondents was $47-52 per barrel. Today, WTI is trading at $64.94 (see the graph below for WTI prices over the past month):

Another crucial metric for the American oil industry is the Brent-WTI spread, which is the difference in price between Brent crude, an international benchmark based on North Sea oil, and WTI, the American oil index. A wide Brent-WTI spread indicates a relatively large discount for American oil compared to the international benchmark, making it more attractive for foreign importers. As of Friday morning, the Brent-WTI spread was $5.36, representing an increase of about $1.45 since January 2017.

Another crucial metric for the American oil industry is the Brent-WTI spread, which is the difference in price between Brent crude, an international benchmark based on North Sea oil, and WTI, the American oil index. A wide Brent-WTI spread indicates a relatively large discount for American oil compared to the international benchmark, making it more attractive for foreign importers. As of Friday morning, the Brent-WTI spread was $5.36, representing an increase of about $1.45 since January 2017.

International geopolitics have kept oil prices high despite surging American domestic production, which has topped 10M barrels a day each week since early February. OPEC and Russia, who have been cooperating on production curbs in order to prop up prices since January 2017, are said to be in talks to transform their year-to-year deal into a decades-long alliance.

“We are working to shift from a year-to-year agreement to a 10 to 20 year agreement,” said Saudi Crown Prince Mohammed bin Salman in an interview with Reuters on Monday night. “We have agreement on the big picture, but not yet on the detail,” said the prince.

President Trump’s appointment of John Bolton as national security adviser may have been behind a sudden spike in WTI crude futures, which have found a new cap around $66.60. Bolton is a well-known hawk and unilateralist, and his appointment triggered speculation that the United States may seek renewed sanctions against Iran, OPEC’s third-largest oil producer.

“People are focused on the fundamentals of oil and they are very strong right now,” Phil Flynn, senior market analyst at Price Futures Group Inc. in Chicago, said in an interview with Bloomberg by telephone. “We are seeing very strong demand for oil around the globe. As refiners come out of maintenance, we are going to be in a very tight marketplace.”