The advent of commercial production of oil and gas from shale has made geological risk seem, to many, a thing of the past. But the history of oil exploration is one of trying to overcome the odds; for small companies, one too many dry holes means failure and substantial amounts of research and effort have gone into improving the odds for success.

It is often said in more prosaic terms that what makes a prospective area attractive to wildcatters is the discovery of oil. Once the first find is made, many other companies flood into the area. This reflects the nature of exploration risk, but too many treat wildcats as a role of the dice: you can’t predict that any given well will be successful, so you should assume the worst. But in reality, exploratory risk has been reduced by advanced imaging technologies though it is hardly eliminated.

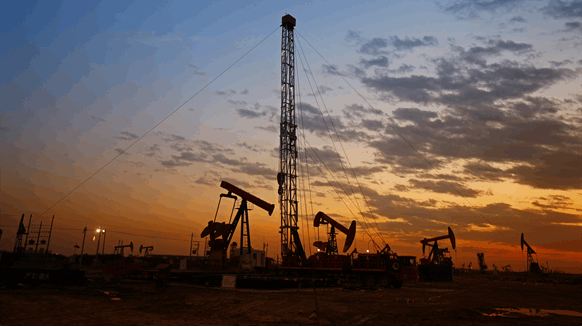

Which highlights one of the attractive principles of shale basins, namely the continuous nature of the resource. Very little exploration risk is incurred by drillers and it is profitable to acquire large tracts with the intention of developing them incrementally. This has led some to refer to the shale industry as being more like a manufacturing process than the exploration for and production of conventional oil.

This is why leases in frontier areas usually involve commitment to a minimum number of wells by the exploring company. In hostile (expensive) environments such as offshore Arctic plays, where wells can run into the hundreds of millions of dollars, committing to multiple efforts can be extremely risky.

On the other hand, a cheaper well in a new area which is conventionally located, such as onshore South America, might be better treated as an element of manufacturing than a roll of the dice. While obviously success rates are lower than in shale areas, nonetheless if the geology has been studied than the explorer should recognize that it is rarely a matter of if oil will be found, but when.

At the company level, Bijan Mossavar-Rahmani, an international oil and gas executive, once explained to me that most companies try to minimize risk and financial outlays by signing exploration contracts for new areas that commit them to as little work as possible, with the intention to continue drilling only if a discovery is made. Otherwise, they drop the sometimes very prospective and effectively untested acreage and go elsewhere. But his strategy was to recognize that an oil province will likely yield discoveries given enough time and effort. So the strategy was to continue to explore beyond the initial commitment until, hopefully, the code was cracked.

Needless to say, for small companies it can be risky to commit to a lengthy program of exploration in one country, but this type of risk has long been offset by joint ventures. Certainly, any given company might choose to accept the perceived risk, with the full knowledge of shareholders, but overall there simply needs to be recognition that geological risk is much more a case of probability than hit or miss, and by committing to a regular plan of drilling, a company is likely to guarantee success, even if it is not a once-in-a-lifetime hit. Numerous moderate producers can be just as profitable as one larger field, with the right fiscal regime of course.