The drilled-but-uncompleted well count, which documents questionable capital expenditures by U.S. shale companies, was essentially unchanged during the last year. The decline in demand and resulting drop in drilling activity caused by the pandemic, combined with numerous M&A actions, hampered operators’ ability to reduce the number of DUCs. However, this is starting to change, with some geographic regions showing a reduction in inventory.

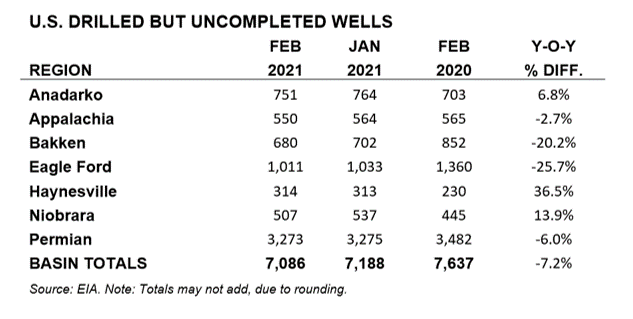

As of February, the U.S. DUC total stood at 7,086, 7.2% less than reported by EIA a year earlier (7,637 wells). DUCs in the Permian basin remained high, with 3,273 tallied in February, just 6.0% fewer than the year-ago figure of 3,482. However, significant reductions were reported in the Eagle Ford (1,011) and Bakken (680) shales, which experienced declines of 26% and 20%, respectively (y-o-y). However, two regions showed increased inventories, including the Haynesville (314) and Niobrara (507), with builds of 37% and 14%, respectively (y-o-y). The Anadarko (751) and Appalachia (550) regions were essentially unchanged.

More relief in sight? According to industry data provider Lium, the DUC count will decline to approximately 5,000 by the end of this year, a decrease of approximately 2,086 wells, compared to the latest EIA numbers. After history’s worst crude crash last year, it appears shale companies have cut back on drilling and focused on completing DUC wells, reducing the so-called “fraclog.” However, the number of rigs drilling in U.S. oil plays has increased 80% since bottoming out during August 2020.If U.S. producers have learned from past mistakes, and can keep a lid on drilling, even as crude rebounds, the DUC count could decline even farther.

But major investment firms are skeptical and see little value in producers’ promises of frugality. How the fragmented U.S. shale industry will respond to increased incentives to drill has become a crucial question for traders and industry experts around the world. Many have suggested producers’ discipline won’t last as oil extends a recovery from historic lows to trade at around $60/bbl. Some companies will exercise restraint for a few months, but there’s too much equipment and expertise ready to work for shale producers to hold back after mid-year.

Trillion-dollar question. Hopefully, U.S. operators will finally show fiscal responsibility and continue to work down the DUC backlog before drilling new wells. James West, senior managing director at Evercore ISI, said, “operators have spent $1 trillion developing U.S. shale plays but have returned only $750 billion. That’s not a good investment.” The question is how much has our industry “invested” in the current 7,086-DUC backlog? And when can stakeholders expect a return, especially in the Permian basin? Maybe 2021 will provide some answers.