Summary

Natural gas producers are soft guiding flat production in 2021.

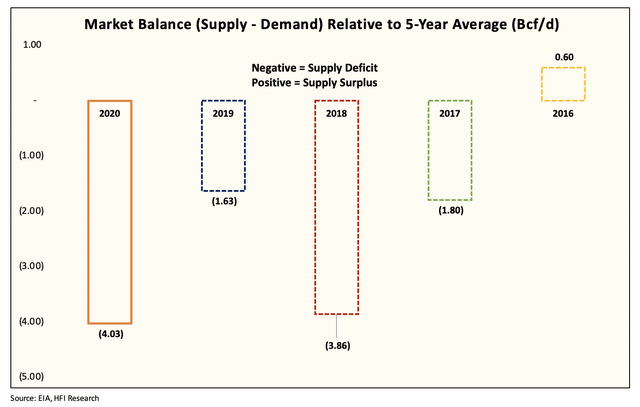

This bodes very well for natural gas fundamentals as the deficit of ~5 Bcf/d will persist in 2021.

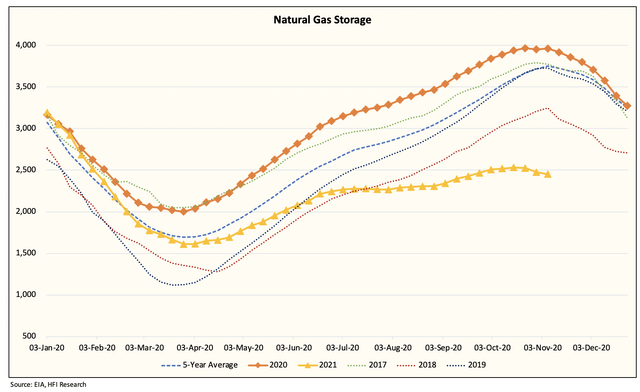

Even if this winter proves to be much warmer than normal, the inherent deficit in the market would prevent storage from building back up for the 2021/2022 winter.

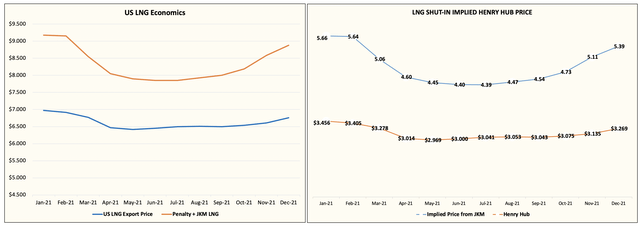

This means that the only way for the US natural gas market to balance itself out will be to cause LNG exports to shut-in again. Depending on global LNG market, this could imply significantly higher Henry Hub prices to force the shut-ins.

Stay bullish producers as the supply deficit is set to overwhelm the market. In the near term, we are staying on the sidelines awaiting the technical correction and the onslaught of near-term bearish weather trends. We will give an update when we do go back long EQT.

Looking for a helping hand in the market? Members of HFI Research get exclusive ideas and guidance to navigate any climate. Get started today »

Welcome to the what does it mean edition of Natural Gas Daily!

Maintenance capital and generating free cash flow, those are two terms you didn’t hear from US shale gas producers during the boom years from 2012 to 2018. Despite natural gas prices averaging horrendous prices during those years, shale gas producers were the first ones to pioneer the mantra of “grow at any cost” and it led inevitably to a massive gas glut that started in 2012 and lasted until today.

Now with 2021 on the horizon and Henry Hub gas curve averaging well above $3/MMBtu, the entire investment community is fixated on just what these shale gas producers will do? Between all the publicly traded natural gas producers, total production volume represents ~20% of US gas production. So this soft capex guidance is very meaningful for the gas balance going forward.

So where do we stand today?

EQT (NYSE:EQT) already has noted that they will be looking to keep production flat.

Cabot (NYSE:COG) basically said the same thing where they will be targeting a maintenance capex program.

Then there are producers like Antero (AR), infamous for growing production at any cost from 2012 to 2017, and even guys like this are doing a complete 180.

Range Resources (NYSE:RRC), which had a conference call today, soft guided the same thing. Maintenance capital and free cash flow will be their priority.

So now if you match up the sentiment in the shale gas patch with what we are already seeing for US gas production and the incoming fundamental deficit, the outlook starts to get really bullish.

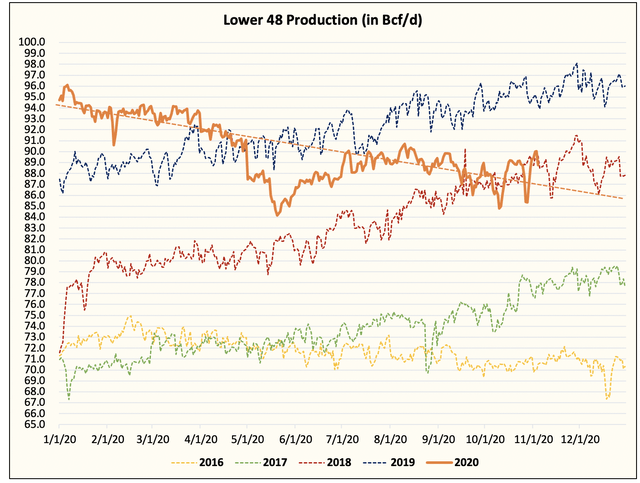

Given the low levels of activity today, we have US gas production bottoming out around ~84 to ~86 Bcf/d by March 2021. If these soft guidance figures are of any substance, then we have on our hands at best ~86 to ~88 Bcf/d average throughout 2021.

And with the natural gas market balance solidly in the deficit at ~4.03 Bcf/d even with bearish weather on the horizon, it’s pretty much an impossible task to fill up storage in 2021. Here’s an illustration. Hypothetically, even if we end winter with very warm weather and storage ends April around ~1.6 Tcf, here’s where we will be by November 2021.

Now the only way to avoid this forecast is for US natural gas prices to surge to the point of shutting in LNG, which means the entire 2021 curve has to be closer to $4/MMBtu.

Source: CME, HFI Research

This, in our view, is the only reasonable way we can have enough gas in storage by November 2021. Now if the global LNG market improves even more throughout the winter, then that gas curve will have to go even higher.

All in all, given the current guidance from NG producers, we don’t see how natural gas market balance can survive 2021 without forcing LNG economics to go negative, which means Henry Hub has to increase to compensate for it.

Stay bullish producers as the supply deficit is set to overwhelm the market. In the near term, we are staying on the sidelines awaiting the technical correction and the onslaught of near-term bearish weather trends. We will give an update when we do go back long EQT.

Read it from seekingalpha – Photo by Pixabay from Pexels