The Permian basin has been by far the largest source of production growth in the US as the field oil production grew from 1.2M barrels per day (mmbpd) in January 2013 to over 4.2 mmbpd. Back in 2013, few observers (myself included) expected the Permian to grow as fast and as large as it did. However, the important question for energy investors at this point is how far and fast the Permian will expand in the coming years, finding the answer to this question holds the key to future oil prices since the Permian has been the engine of non-OPEC supply growth over the last several years.

In this article I will present a number of recent projections and observations by a variety of independent experts, CEOs, investment funds and research outfits as to where Permian (and US shale) oil production might be headed in the coming years. It suffices to say that the Permian and US shale growth outlook looks decidedly more subdued than what we have witnessed over the last few years.

Goehring & Rozencwajg

Goehring & Rozencwajg, arguably one of the most astute commodity investment funds, published the following comments in their Q2/19 commodity markets report:

The Permian should grow production by another 2 m b/d before peaking around 6.5 m b/d sometime between 2029 and 2032 … However, while this growth is impressive, it only represents growth of ~200,000 b/d per year, far below the ~700,000 b/d of yearly growth over the last two years.

G&R goes on to say the following for US shale production as a whole:

We expect the three major US shale basins will grow by another 2.7 to 2.9 m b/d in total before peaking around 10 m b/d sometime between 2027 and 2029. This equates to somewhere between 275,000 and 360,000 b/d of growth per year compared with nearly 1 m b/d of annual growth from the three basins each year between 2017 and 2019. We should point out that these figures may be slightly higher in the early years and 2019 could actually see growth in excess of 700,000 b/d from January 1st to December 31st. However, we believe 2019 will be the last time growth exceeds 500,000 b/d as production starts to slow dramatically.

G&R reached their conclusions through the application of their propriety neural network. G&R’s neural network has demonstrated impressive accuracy in tracing historic US shale growth. G&R’s strong track record and impeccable research offers much credence to their muted US shale (including the Permian) growth projection.

Rystad Energy

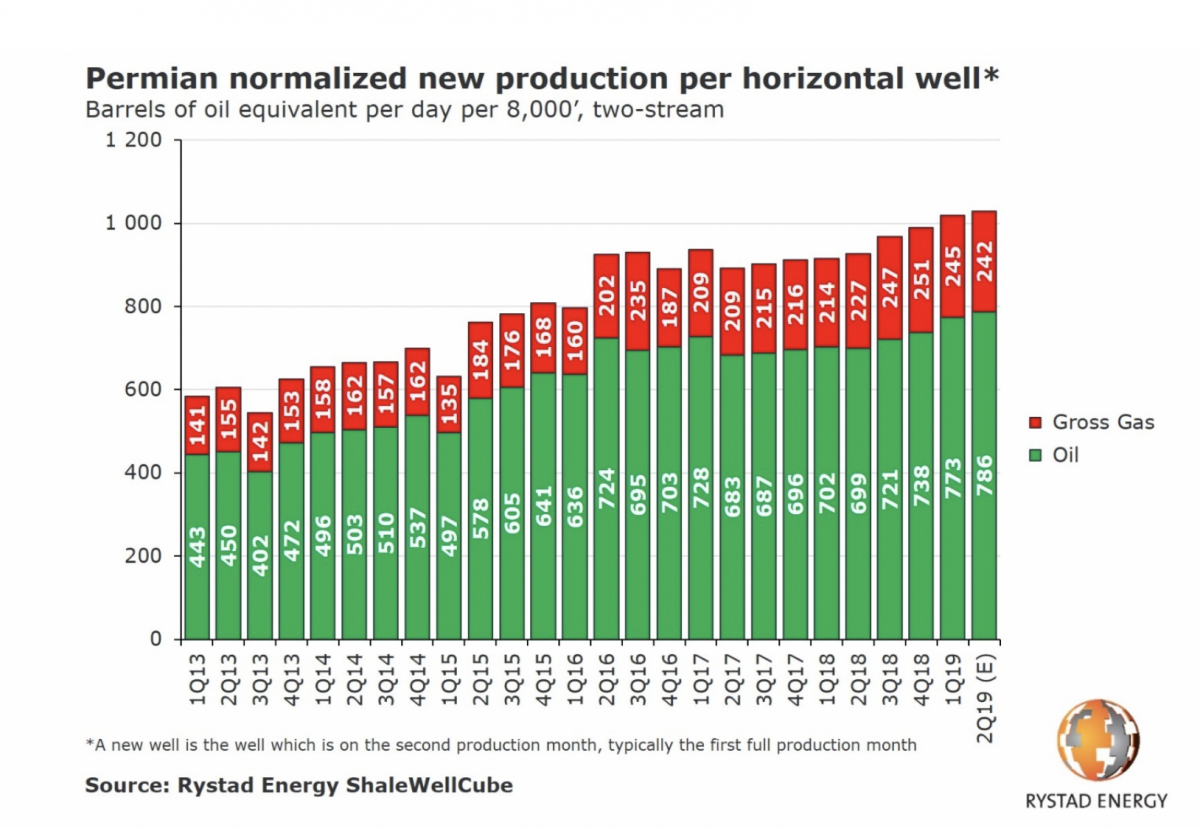

Rystad Energy has been a strong believer in the US shale revolution and the consulting firm has done excellent work to understand the underlying trends driving US shale oil supply growth. Recently the consultancy published an insightful graph on horizontal Permian well productivity:

Using the data in the above graph, I have produced a new graph showing the YoY change in Permian well productivity (oil portion) in relation to WTI:

Rystad productivity data shows a noticeable slowing down in YoY Permian horizontal well productivity, while productivity increased by as much as 28% YoY in Q1/16 that growth slowed to 10% YoY in Q1/19. As a matter of fact, productivity growth trended between negative and the low single digits for most of 2017 and 2018. As we look at changes in Permian well productivity in relation to WTI we can concluded that high grading has played a key role as operators drill their best acreage during period of declining prices while doing the opposite during periods of low prices (This observation has been confirmed by Rystad Energy as well). Its quite clear that Permian horizontal well productivity improvements have largely stalled since Q2/16, with productivity increasing by a mere 6.7% in the 2.5 years time span since then. In regard to where US shale production growth (including the Permian) is headed in the coming years, this is what Rystad Energy had to say recently:

Although light oil production volumes from US shale continue to grow, the expansion is expected to slow down, with light oil additions declining towards 2023, driven by a flat development in drilling and completion activity.

Fitch Ratings

Fitch Ratings is expecting a pronounced slowdown in US shale growth in the coming years as the YoY growth rate slows down from 15% in 2018 to around 6% in 2020:

(Source: Fitch Solutions)

A recent article on Fitch Solutions, provides more color on Fitch’s outlook:

Shale producers have racked up major gains in well productivity and operational efficiency since oil prices collapsed in 2014, reviving profits in the face of substantially lower prices. That said, these gains are not inexhaustible and there are signs that well productivity is trending downwards, reflecting growing issues with well interference, as the number of child wells eclipses parent wells in the Permian, the main engine of US growth. Further cost savings can be made, such as through consolidation of contiguous assets and the industrialisation of shale production processes, and the growing role for the majors and the larger independents is a positive sign in this regard. Nevertheless, we believe prices will be a constraining factor for growth over H219 and 2020.

Wood Mackenzie

Wood Mackenzie, another respected oil and gas consultancy, is witnessing similar trends as accelerating decline rates, pipeline constraints and rising produced-water volumes are believed to impact the Permian long-term production potential. The consultancy is estimating average initial production rates for Wolfcamp wells drilled in the Midland Basin to be down 6 percent so far this year, along with productivity reductions observed across numerous benches. More from MRT:Related: Trump Pushes Venezuela To The Brink

“Every play eventually matures” said Ryan Duman, senior analyst, Lower 48 with Wood Mackenzie, in an email. “As more wells are drilled and core inventory is exhausted, it becomes increasingly difficult to grow production,” he wrote from Denver, where he discussed produced water challenges in the Permian. “Typically, the slowing of production growth rates or outright declines in production leads to a ‘mature’ play status. The Permian isn’t there yet, but as more wells are drilled in the coming years, we’ll approach a more mature status. That said, further delineation of new zones or geographies can dramatically slow play maturity.”

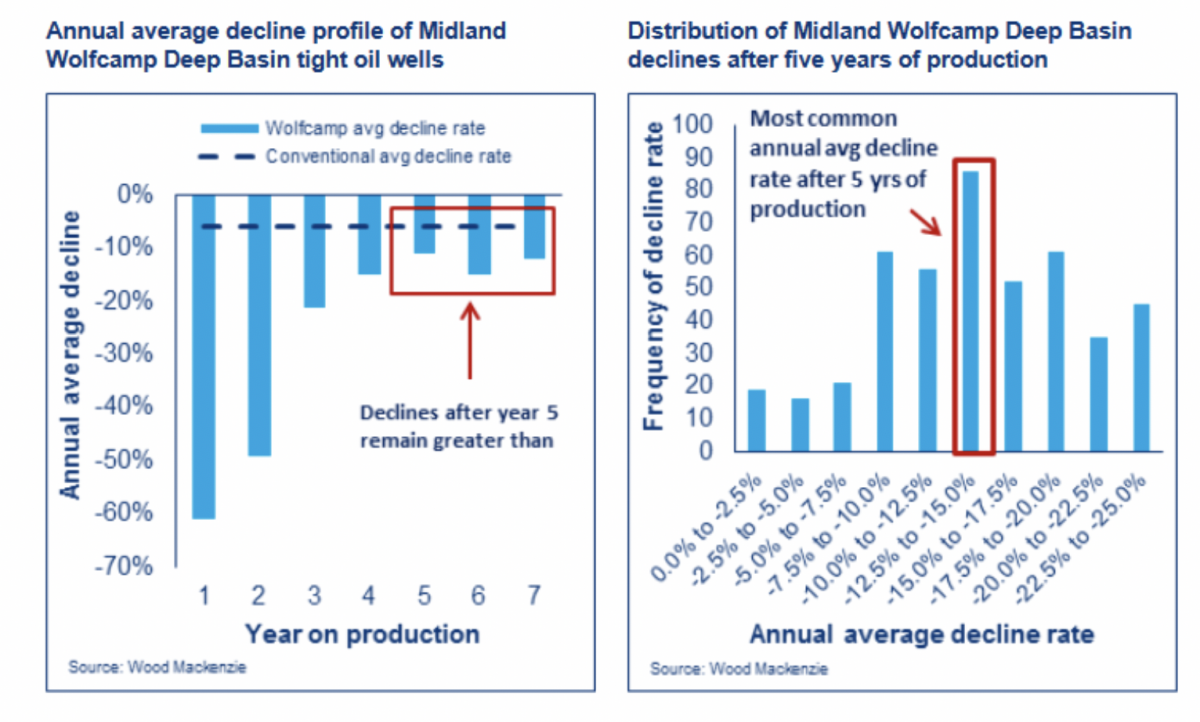

Wood Mackenzie recent Permian slowdown comments echoes a June 2018 study where the firm observed an acceleration in the terminal decline rates for Permian horizontal wells:

The study found that, after five years of production, the most active Wolfcamp subplays have annual decline rates roughly double the proxy value of 5% to 10% that is commonly used. The most common terminal decline value actually observed in mature horizontal Wolfcamp wells was 14%. The report analyzed the impact of the more plausible terminal decline rates and found that under a 14% terminal decline scenario, the near-term impact to total Permian supply is relatively minimal, but by 2040 nearly 800,000 bbl/day of Permian production is at risk.

Pioneer Natural Resources’ Scott Sheffield dials back

In a recent conference call, Scott Sheffield, CEO of Pioneer Natural Resources made this key comment as to his view on the Permian future supply growth:

I am lowering my expectations of the Permian, reaching 1 million barrels of oil per day growth annually as it did in 2018. I’m still convinced the Permian will reach 8 million barrels a day at a much slower pace with the Midland Basin as the only growing basin in the U.S. past 2025…the Delaware is being drilled aggressively by many more operators. Rig count and Tier 1 acreage is being exhausted at a very quick rate. Similar reports have Delaware peaking in 2024 because of the aggressive drilling and down spacing because companies are essentially running out of inventory. The same reports are showing that the Midland Basin will not peak until the mid-2030s.

The above remarks are noteworthy for Mr. Sheffield had been an ardent believer in the Permian, stating in 2013 that the Spraberry Wolfcamp could possibly become the largest oil and gas discovery in the world.

Mark Papa (ex-CEO of EOG) skepticism

In a recent conference call, Mark Papa, CEO of Centennial Resources (ex-CEO of EOG and one of the famed US shale pioneers) had this to say about US oil supply growth in 2020:

It’s already apparent to me that 2020 total U.S. oil growth will be considerably less than the 1.2 million barrels a day, year-over-year than most people are currently forecasting.

Its worth noting that earlier this year, Mark Papa expressed skepticism as to the US shale industry ability to deliver the same kind of productivity growth it did in the past:

“I am not particularly optimistic that, over the next 5 years, the industry is going to be able to show the year-over-year improvements in well recoveries that we’ve seen over the past 10 years,” said Mark Papa, chief executive officer of private-equity-backed shale producer Centennial Development Resources. Papa said the two biggest factors at play are frac hits, or parent-child well interference, and a shrinking inventory of high-quality drilling locations.

Concho Resources failed down spacing experiment

On August 1st Concho reported a disappointing outcome for their Dominator down spacing experiment in the Delaware basin:

In the Delaware Basin, the 23-well Dominator project was designed to test logistical capabilities and well spacing that was approximately 50% tighter than our current resource assessment. While initial rates were solid, current performance data indicates that we developed the Upper Wolfcamp too densely.

Concho’s failed experiment lead to a severe 22% decline in the stock price that day. It also led to questions as to Permian (and US shale) growth potential from the likes of Goldman Sachs:

“Unfavorable spacing tests and lower than forecast capital efficiency raise justifiable questions whether we are further down the path to when shale no longer becomes as relevant a driver of global supply growth,” Goldman Sachs analysts wrote in a note. The investment bank said that bad result from Concho offers some evidence that the inventory of remaining drilling locations “stops rising and starts falling.” It could also be an indication that capital efficiency is degrading, which could mean that supply costs could rise going forward.

HFI Research

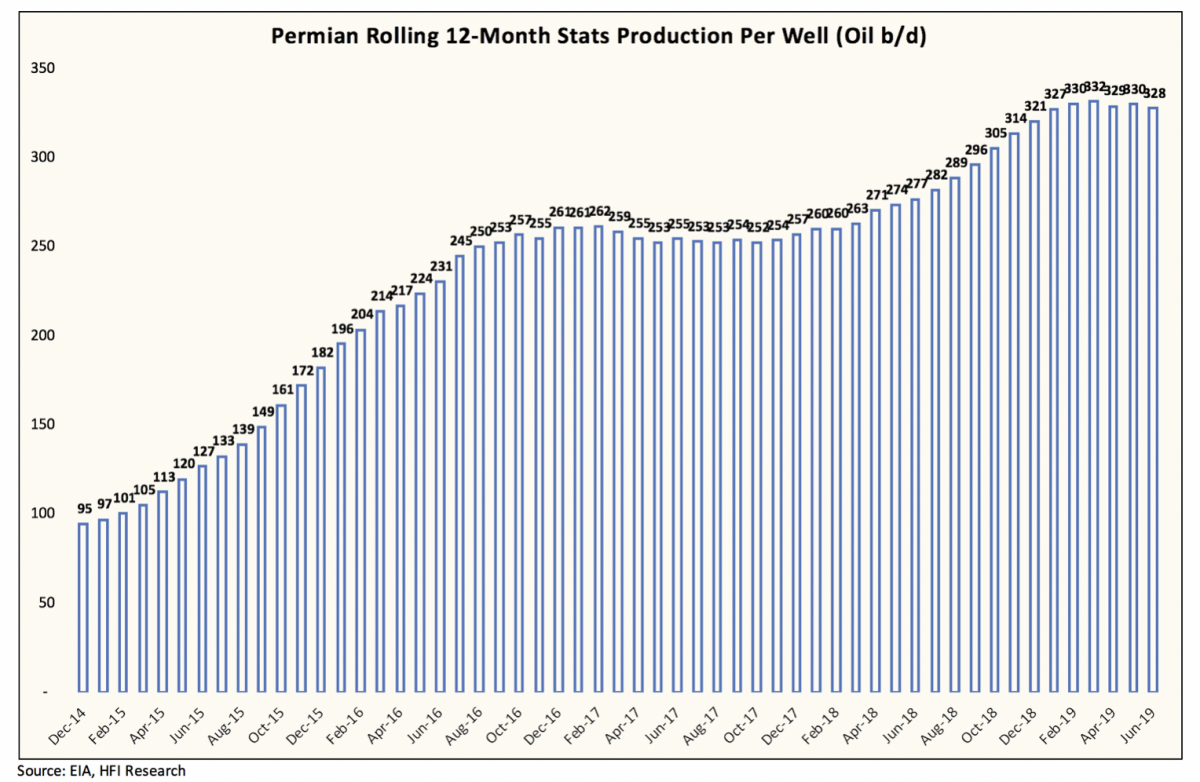

In a recent article, HFI research delivered a stark warning on Permian productivity and future growth:

We are seeing the Permian basin starting to stall, While we still expect the Permian to be the biggest growth contributor going forward, the speed and pace of the growth will start to level-off materially. By our estimate, if the Permian doesn’t see a sizable step change upward in well completions, then we will see production growth level out by 2023/2024.

Conclusion

It is important to note that the Permian oil production will continue to grow for many years to come as the super majors such as Exxon and Chevron continue to invest heavily in the basin and as the fracking pace in the field continues to break records. However, the warnings raised by the many experts and professionals highlighted in this article are clear: Permian productivity and growth are slowing down already and will be slowing materially in the coming years. A slowdown in a single oil field in a single country may not seem material to some, but when one learns that the US has been the source of almost 100% of the growth in non-OPEC production since 2015 and that the lionshare of that growth is coming from the Permian, a material slowdown in the Permian will have a disproportionate impact on global oil prices in the upcoming decade.

By Nawar Alsaadi for Oilprice.com

Read it from Oilprice.com – photo as posted on Oil Price