The rise of U.S. tight oil production over the last several years has upended the oil market and challenged OPEC’s hold on oil prices. This seemingly relentless growth in U.S. tight oil production has created the impression that oil prices will remain forever capped as each price spike is met by a massive wave of US tight oil supply.

Overview

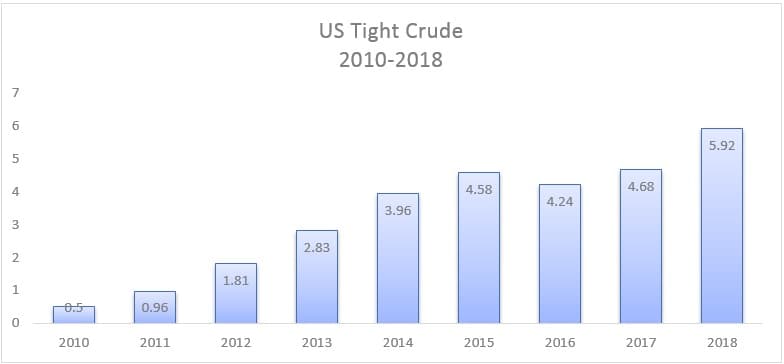

U.S. tight oil supply has grown from a mere 500K barrels in 2010 to just under 6M barrels in 2018. Following the oil crash of late 2014, U.S. tight oil growth experienced a brief pause in 2015-2016 before resuming its growth in 2017 and climbing to a new high by 2018. This latest growth spurt to a new record is even more impressive when we take in consideration the fact that WTI averaged $65 a barrel in 2018 as compared to $95 a barrel in the three years (2012-2014) preceding the oil crash.

(Source: OPEC WOO – 2018)

Most observers attribute this strong shale industry performance to technology and improved drilling and completion practices. We are told that American oil and gas companies have become more efficient. The widespread utilization of pad drilling, the introduction of longer laterals, pumping ever more sand per foot, closer and better well spacing, and smart fracture targeting are often mentioned as the driving factors behind the industry record beating performance. This narrative of technological prowess and innovation is an attractive one, but a deeper examination of the data reveals a different picture.

Analysis

This fallacious narrative of the U.S. tight oil industry overcoming the oil price crash of 2014 through innovation and better efficiency is the product of bundling various tight oil basins under one umbrella and the presentation of the resulting production data as a proof U.S. shale resiliency.

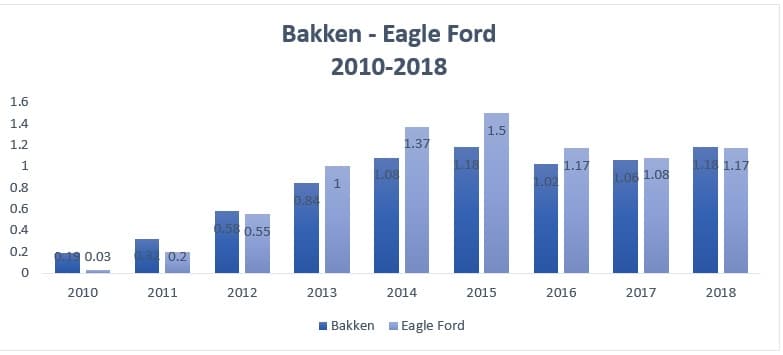

To properly understand the impact of the oil price crash of 2014 on U.S. tight oil production one must focus on shale basins with sufficient operating history prior to the oil price crash and examine their performance post the crash. To that end, the Bakken and the Eagle Ford are the perfect specimen. The Bakken and the Eagle Ford are the two oldest tight oil basins in the United States, with the former developed as early as 2007 and the latter in 2010. Examining the production performance of these two basins in the 4 years preceding the oil crash and contrasting it to the 4 years subsequent to it, offers important insight as to the resiliency of U.S. tight oil production in a low oil price environment.Related: Oil Jumps As Saudis Plan Further Production Cuts

(Source: OPEC WOO 2018)

Both the Bakken and the Eagle Ford grew at a phenomenal rate between 2010 and 2014. The Eagle Ford grew from practically nothing in 2010 to 1.3M barrels by 2014, while the Bakken grew five fold from 190K barrels to 1.08M barrels. Following the collapse in oil prices in late 2014, the Bakken and Eagle Ford growth continued for another year, albeit at a slower pace, as the pre-crash momentum carried production to new highs. However, by 2016, both the Bakken and the Eagle Ford went into a decline and have hardly recovered since. It took the Bakken three years to match its 2015 production level, meanwhile the Eagle Ford production remains 22% below its 2015 peak. During the pre-crash years these two fields grew by a combined yearly average of 600K to 700K barrels from 2012 to 2014. Post the oil price collapse, this torrid growth turned into a sizable decline by 2016 before stabilizing in 2017. Growth in both fields only resumed in 2018 at a combined yearly rate of 210K barrels, a 70% reduction from the combined fields pre-crash growth rate.

The dismal performance of these two fields over the last few years paints a different picture as to U.S. tight oil resiliency in a low oil price environment. The sizable declines, and muted production growth in both the Bakken and the Eagle Ford since 2014 discredit the leap in technology and the efficiency gains narrative that has been espoused as the underlying reason beyond the strong growth in U.S. oil production. As we expand our look into other tight oil basins, it becomes apparent that it was neither technology or efficiency that saved the U.S. tight oil industry, although these factors may have played a supporting role. In simple terms, the key reason as to the strength of U.S. production since the 2014 oil crash is better rock, or rather, the commercial exploitation of a higher quality shale resource, namely the Permian oil field.

(Source: OPEC WOO 2018)

The Permian oil field, unlike the Bakken and the Eagle Ford, was a relative latecomer to the U.S. tight oil story. It was only in 2013, only a year before the oil crash, that the industry commenced full scale development of that giant field’s shale resources. Prior to 2013, the Permian lagged both the Bakken and the Eagle Ford in total tight oil production and growth. As can be seen from the preceding graph, the oil crash had only a minor dampening effect on the Permian oil production growth. By 2017, Permian tight oil growth resumed at a healthy clip, and by 2018, Permian tight oil production growth shattered a new record with production skyrocketing by 860K barrels in a single year to 2.76M barrels. This timely unlocking and exploitation of the Permian oil basin masked to a large degree the devastation endured by the Bakken and the Eagle Ford post 2014. In essence, the U.S. tight oil story has two phases masquerading as one: the pre-2014 period marked by the birth and rise of the Bakken and Eagle Ford, and the post-2014 period, marked by the rise of the Permian. To speak of the U.S. tight oil industry as one is to mistake a long-distance relay race for the accomplishment of a single runner.

The performance divergence between the Bakken, Eagle Ford, and the Permian has major implications as to the likelihood of U.S. tight oil production suppressing oil price over the medium and long term. A close examination of U.S. tight oil production data leads to a single indisputable conclusion: without the advent of the Permian, the U.S. tight oil industry would have lost the OPEC lead price war. Hence, it’s a misnomer to treat the U.S. tight oil industry as a monolith, in many ways, the Bakken and the Eagle Ford tight oil fields are as much a victim of the Permian success as the OPEC nations themselves.

Implications

This discordant panoply of shale fields known as the U.S. tight oil industry has been the key source of global non-OPEC oil supply growth over the last several years and is expected to be for years to come:

Considering that the majority of U.S. tight oil production growth is generated by a single field, the Permian, changes in the growth outlook of this basin have major implications as to the evolution of global oil prices over the short, medium and long term. Its important to keep in mind that the Permian oil field, despite its large scope, is bound to flatten, peak and decline at some point. While forecasters differ as to the exact year when the Permian oil production will flatten, the majority agree that a slowdown in Permian oil production growth will take place in the early 2020s.

According to OPEC (2018 World Oil Outlook), the Permian basin oil production curve is likely to flatten by 2020, with growth slowing down from 860K barrels in 2018 to a mere 230K barrels by 2020:

(Source: OPEC WOO 2018)

There are many factors that can accelerate or delay the projected flattening phase, but there is no doubt that sooner or later Permian oil production will flatten. An eventual plateau in Permian oil supply effectively translates into a flattening of non-OPEC global oil supply, the importance of this event can’t be overstated. The year the Permian flattens is the year OPEC will regain control of the market, this seminal event will have major implications on long term oil prices. There is no doubt that Saudi Arabia and Russia are aware of the Permian growth and flattening dynamic and are co-managing their oil supply over the short term and medium term to allow for an orderly entrance of U.S. tight oil supply, aka Permian oil supply, into the market. It’s indeed telling that OPEC is attempting to extend its alliance with Russia for another three years, exactly the time window required for growth in the Permian oil field to flatten and for pricing power to return to it.

The U.S. tight oil story is far more complex than meets the eye, and the oil market, like any market, is prone to the appeal of simple narratives and false conclusions. Those willing to drill behind the headlines stand to capitalize on the treasures buried in the details.

By Nawar Alsaadi for Oilprice.com