Texas is facing a burning question that’s pitting the state’s economy against its environment, and oil drillers against each other.

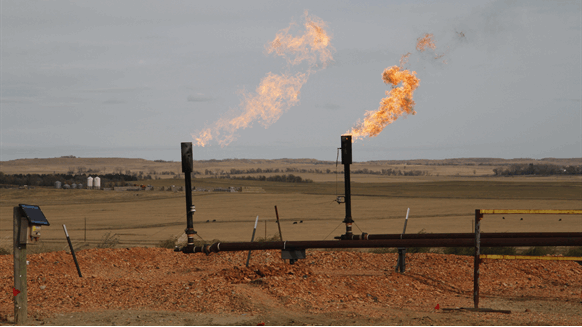

With natural gas pipelines in the Permian Basin reaching 98 percent of capacity, Texas is weighing whether to keep intact or loosen strict state regulations that limit flaring, the process used by drillers to burn off excess gas pumped up along with their oil. Now the limit for individual wells is 45 days. After that, without a rare-granted exemption, the gas must be piped away or the well must close.

Shut wells mean less revenue for companies and the state at a time when oil prices and production are surging while regional gas prices are in a tailspin. Ending or expanding the cap solves the problem. But it also gives drillers that haven’t paid for space on existing pipes a competitive edge over those that have, and could spark environmental protests.

“This is not a simple thing we’re talking about,” said Ryan Sitton of the Texas Railroad Commission, which oversees the oilfields. “It’d be a pretty big policy shift and we want to be very thoughtful about what the ramifications could be.”

Sitton said he’s meeting with producers across the Permian, and hopes to have a decision within six months, when he believes the dilemma will come to a head.

Two Percent Left

Multiple gas pipelines criss-cross the Permian, with a total capacity of 8.1 billion cubic feet a day. But as the price of crude has risen, so has production, growing 25 percent in the last year. The gas associated with that boom has filled up all but two percent of pipeline capacity as of the end of April, according to RBN Energy LLC, and Rystad Energy AS suggests oil output may grow 10 percent more by the end of 2018.

Natural gas prices in the Permian, meanwhile, are the cheapest in the nation.

Spot prices at the Waha hub in West Texas were down 49 percent this year to $2.03 per million British thermal units as of 4:24 p.m. on June 1, according to the Bloomberg assessment. Meanwhile, spot gas at the Henry Hub in Louisiana, the U.S. benchmark, gained gained 1.4 percent over the same period to $2.93.

The region is “ground zero for the oversupply caused by associated gas production,” said John Kilduff, a partner at Again Capital LLC in New York, by email. If oil output continues to boom, gas prices “could certainly go to zero.”

There’s relief on the way, with as much as 10.5 billion cubic feet a day of gas pipelines proposed or being built. But the bulk of it won’t arrive until late next year or in 2020.

In the meantime, changing the rules could affect different constituencies in different ways.

Drillers like Centennial Resource Development Inc., for instance, have paid upfront to guarantee room on existing pipelines, assuming that the current limits wouldn’t be dramatically altered.

Centennial Assumption

“We are operating under the assumption that the Texas Railroad Commission will not allow us or the industry to flare gas for an extended period when takeaway capacity is full,” said Sean Smith, Centennial’s chief operating officer, during the company’s first-quarter earnings call with analysts.

Concern that extended flaring could punish companies already heavily invested in the last space on existing lines is key to the railroad commission, according to Sitton. “How do we do something that is fair and equitable for all producers so that we are not having an artificial market impact?” he said.

Going hand-in-hand with the financial questions are those revolving around air quality. Flaring releases toxic compounds like cancer-causing benzene and matter linked to respiratory illnesses, according to the Environmental Defense Fund, which is against increasing the duration.

Suzanne Franklin, 67, and her husband, James, can see 17 flares breathing fire into the sky from the front porch of their ranch in Reeves County. The visible pollution has definitely impacted their life. “We used to go out and look up at the stars,” she said. “Now, you don’t see any stars.”

She believes the flaring has affected her breathing. Since the first flare was lit up about a year ago, her doctor has put her on three different medicines “just to breath right.”

Seven counties in the region already rank in the top 10 nationwide for childhood asthma attacks, according to the Clean Air Task Force. More flaring could increase that standing, according to Colin Leyden, the fund’s senior manager of regulatory and legislative affairs.

Last Year’s Count

To this point, no increase in flaring has been needed. In the last year, the number of permits have decreased, falling to 194 in April from 217 during the same month in 2016, according to data from the railroad commission.

But even with the number of permits down, the amount of natural gas consumed by flaring is probably up, with wells more productive than they were even six months ago, said Artem Abramov, vice president of shale analysis at Rystad Energy, by telephone.

Texas now flares about 3 percent of the gas produced. Matt Portillo, analyst at Tudor Pickering Holt & Co. , said that could rise as much as five times higher in the next year.

Sitton disagrees. A primary role for the railroad commission “is to prevent waste,” he said. “If you believe that waste is not dollar waste, but the waste of the hydrocarbon molecule, then we have to be very judicious about when we grant flaring exemptions. Those are the questions that we are trying to get our heads around.”

With assistance from Kevin Varley. To contact the reporter on this story: Ryan Collins in Houston at rcollins74@bloomberg.net. To contact the editors responsible for this story: Reg Gale at rgale5@bloomberg.net Joe Carroll.