After a period of sustained improvement, the upstream sector ended a politically tumultuous year on an unexpectedly somber note as oil prices skidded in the final months of 2018 amid oversupply concerns and signs of a cooling global economy.

While these short-term trends have added a cautionary tone to some industry projections, a generally hopeful sentiment remains among analysts. Wood Mackenzie’s senior vice president, Tom Ellacott, for one, believes the upstream sector will thrive this year.

“Oil and gas companies can cope with whatever’s thrown at them in 2019,” Ellacott said in mid-December. “Portfolios are set to weather low prices.”

The midstream sector, meanwhile, roared into 2019 on a wave of pipeline construction activity driven by the continuing global shift toward natural gas, the rapid growth of shale production, and the infrastructure demands created by changing patterns of interregional trade.

The latter is particularly true of the United States, where the lifting of an oil export ban and the predicted growth in global LNG demand has led to massive infrastructure development, especially along the Texas and Louisiana Gulf coasts, including oil and LNG export terminals, new and expanding liquefaction facilities, and the pipeline capacity to supply them.

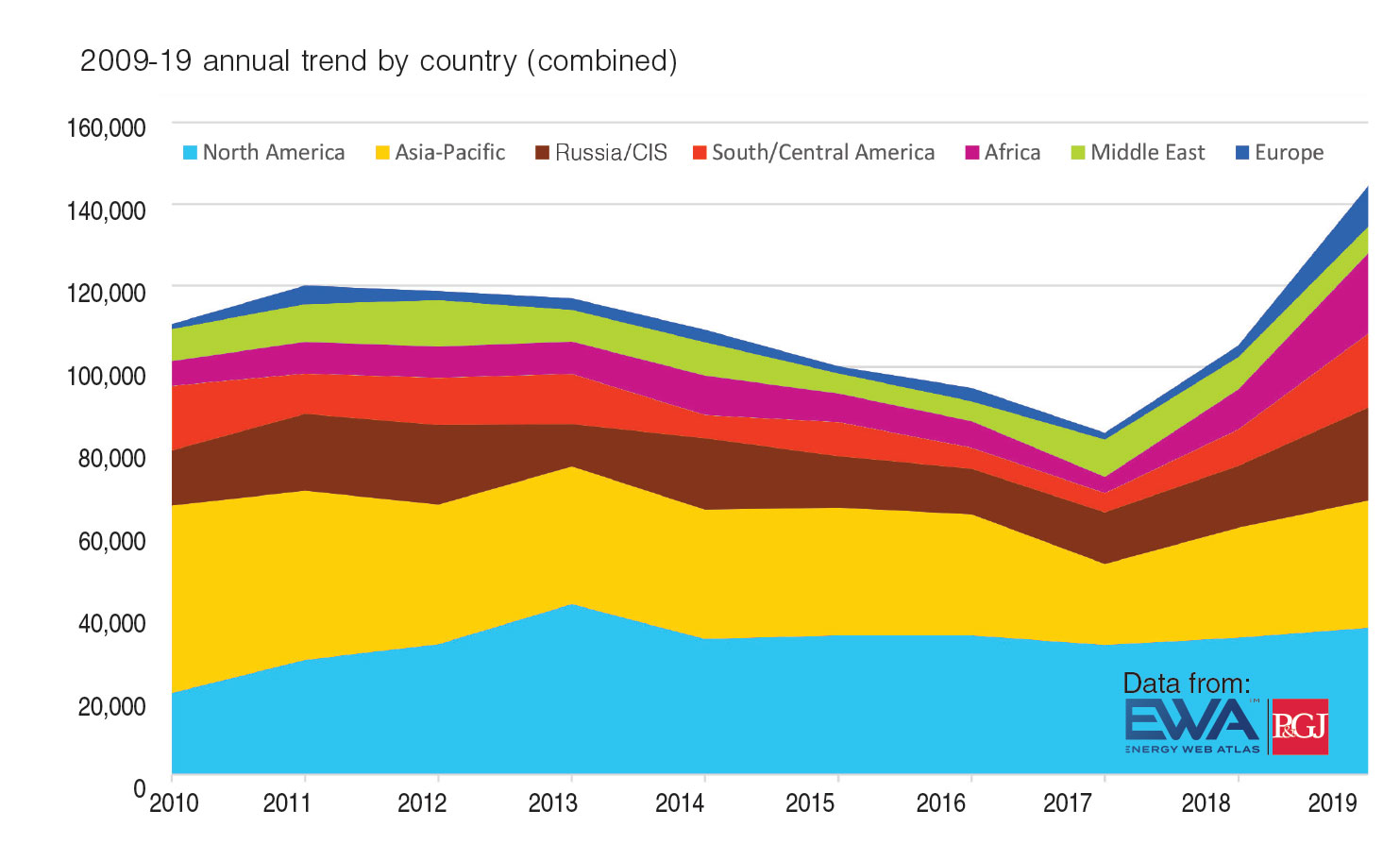

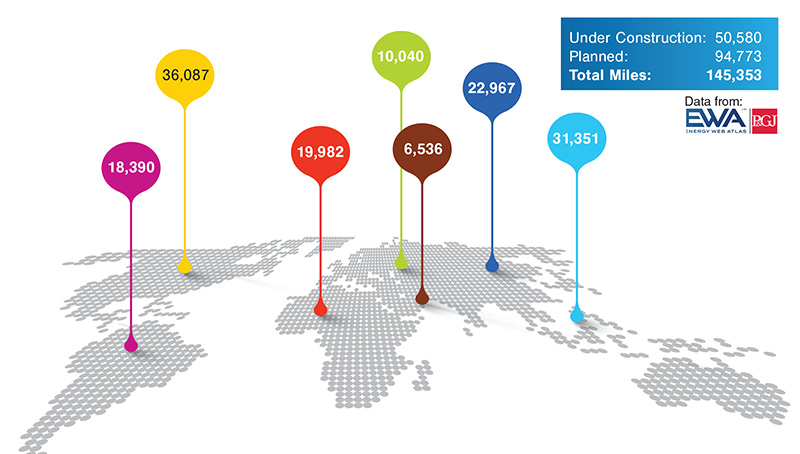

The latest Pipeline & Gas Journal survey based on Energy Web Atlas data, indicates 145,353 miles of pipelines were planned or under construction worldwide at the start of the new year – a 73% increase over survey findings published in January 2017.

The following is an update on new and planned pipeline activity by region:

NORTH AMERICA

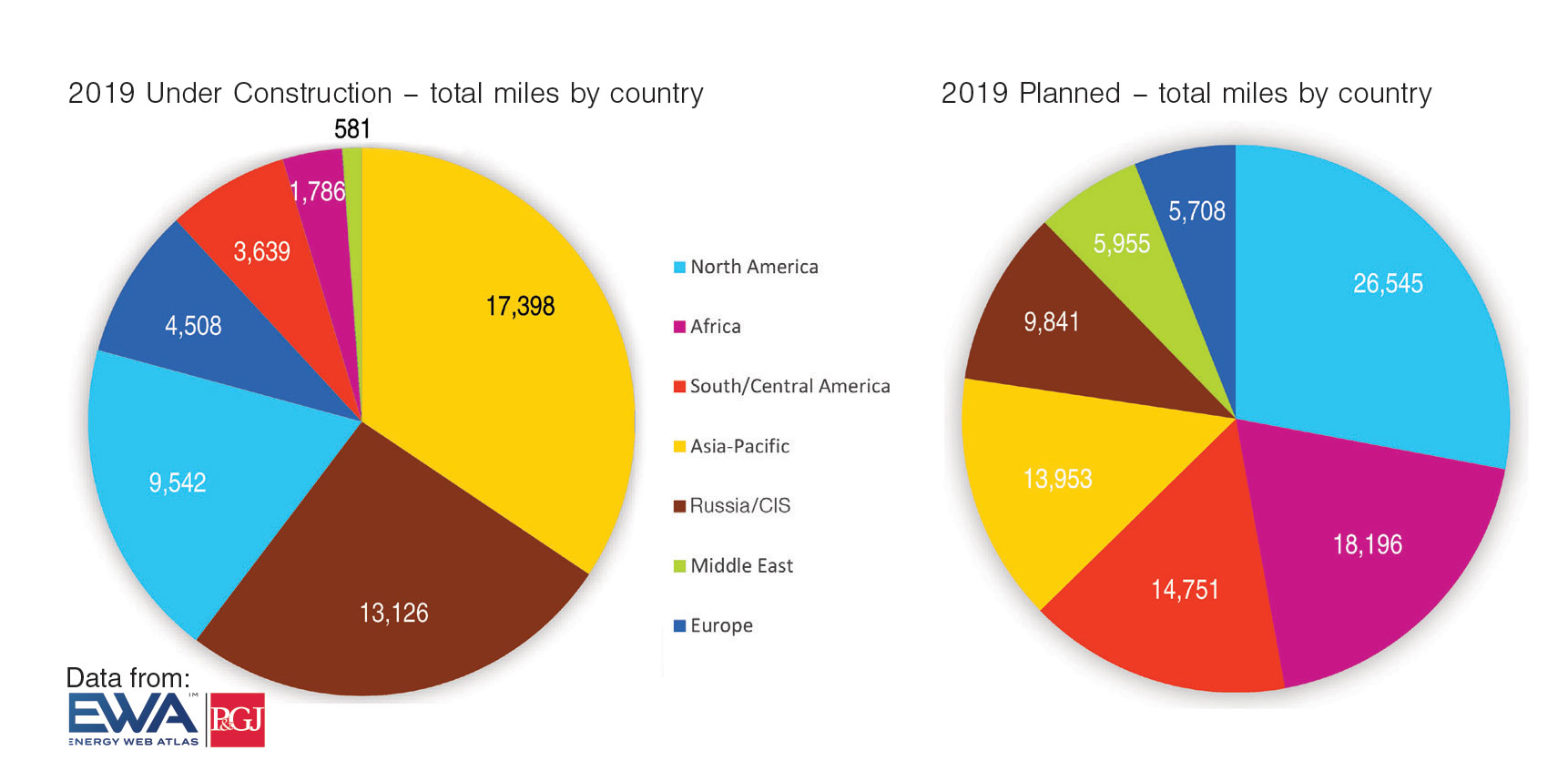

Pipeline Miles Under Construction: 9,542Pipeline Miles Planned: 26,545

Total: 36,087

Pipeline construction activity has increased throughout North America, with the heaviest concentrations around major U.S. shale plays with takeaway capacity constraints – most notably, the Permian Basin of West Texas and New Mexico and the Marcellus/Utica basins of Appalachia.

Pipeline capacity from the gas-rich Marcellus increased in 2018 with the completion of Columbia Pipeline’s Leach Xpress, which added 1.5 Bcf/d of capacity from West Virginia in January, and Williams’ Atlantic Sunrise project. A $3 billion expansion of the Transco system, Atlantic Sunrise added 186 miles of greenfield pipe in Pennsylvania and 1.7 Bcf/d of takeaway capacity when it began full operations in early October.

The $5 billion, 600-mile (970-km) Atlantic Coast Pipeline is a 42-inch natural gas pipeline developed through a joint venture between Dominion Energy, Duke Energy, Piedmont Natural Gas and Southern Company Gas. The 1.5 Bcf/d pipeline, which has faced opposition and delays, is scheduled for completion in late 2019.

Mountain Valley Pipeline officials said the $4.6 billion project is on target to be fully in-service in the fourth quarter of 2019. Mountain Valley, which spans 303 miles from northwestern West Virginia to southern Virginia, was reported to be 70% complete by the end of 2018, including 58% of all welding, and planned to finish remaining construction of compressor stations and interconnects by February.

Additional Marcellus projects include Mountaineer Xpress, which will add 2.7 Bcf/d, and TCO’s Columbia Gulf and WB Xpress expansions, which will combine for up to 2 Bcf/d of capacity. Rover Phase 2 adds 3.25 Bcf/d to the Midwest and Ontario, and NEXUS Pipeline, which follows a similar route to Rover, will deliver 1.5 Bcf/d of new capacity.

In the Permian Basin, more than 2 MMbpd of pipeline capacity has been proposed and several of those projects have moved forward following successful open seasons that revealed strong customer interest. Production in the hottest U.S. shale oil play began pushing against takeaway capacity in 2017, causing tariffs to rise, and surpassed it during 2018.

A number of major Permian projects are scheduled for completion during 2019, including the 730-mile Epic crude oil pipeline to Corpus Christi, Texas, which is developing into a major crude and NGL export hub. The Epic crude line will add 590,000 bpd of takeaway capacity, following the path the Epic NGL pipeline which also is under construction.

Plains All American expects first flow on its Cactus II project in the second half of this year. Cactus II was proposed as a 585,000 bpd project linking Permian production to Corpus Christi/Ingleside via existing and two new pipelines. Due to customer interest, and Plains conducted a successful second open season for expanded capacity. Cactus II is expected to start partial service in the third quarter of 2019, and Plains is targeting full service on the 670,000 bpd line in April 2020.

Other notable Permian crude oil projects include the Phillips 66/Enbridge Gray Oak Pipeline to Corpus Christi, Freeport and Houston. Gray Oak, which is scheduled to begin service in the second half of this year, will have an initial capacity of 385,000 bpd.

Most recently, Houston-based Jupiter Energy Group commenced an open season in December for a 650-mile, 36-inch crude oil pipeline with expected completion by the fourth quarter of 2020. The pipeline would have capacity up to 1 MMbpd with origination points near Crane and Gardendale/Three Rivers in West Texas and an offtake point in Brownsville, Texas. Privately held Jupiter said it also is constructing a crude upgrading, processing and export terminal capable of loading VLCCs in the Port of Brownsville.

The Permian pipeline shortage is not limited to crude oil production, however. With associated gas accounting for about a third of the Permian output and regulations limiting the amount of gas that can be flared, natural gas pipeline constraints have also put a ceiling on oil production while pushing gas prices in West Texas down to the lowest of any major U.S. hub.

Fortunately, Mexico is providing an expanding export market for piped gas from Texas, as its southern neighbor has been aggressively expanding its natural gas infrastructure.

In 2012, according to Sener, the Mexican ministry of energy, there were 7,050 miles (11,347 km) of gas pipelines in Mexico, of which 5,665 miles (9,118 km) were operated by Pemex. Since then, 1,496 miles (2,410 km) of gas pipelines have been added to the national grid, and that total is expected to reach 5,420 miles (8,722 km) by the end of 2019.

The 13 existing natural gas interconnections from the United States have an import capacity of about 4.2 Bcf/d, according to the International Energy Agency (EIA), with four of them interconnected to the Integrated National Transportation and Storage System: El Hueco, Cuidad Mier, Reynosa and Argüelles. By the end of this year, five additional interconnections are expected to start operations.

A number of important gas pipelines from Texas and within Mexico have come on line over the past two years, including Enbridge’s Valley Crossing Pipeline, a 168-mile system that added 2.6 Bcf/d of capacity when it entered service in October, and TransCanada’s 348-mile, 670 MMcf/d El Encino-Topolobampo Pipeline, which began service in June.

TransCanada has two more pipelines with expected completion this year: the 178-mile (287 km) Tuxpan-Tula, a $700 million project with a capacity of 886 MMcf/d, and the Tula-Villa de Reyes, a 36-inch, 260-mile (420 km) pipeline, supported by a 25-year service contract with the Comisión Federal de Electricidad (CFE), Mexico’s state-owned power company. [For an in-depth review of projects in Mexico, see the Energy Web Atlas white paper, “Mexico’s Infrastructure Expansion and Five-year Plan.”]

Canada began 2018 with about 42,000 miles (67,706 km) in service and added just over 200 miles (325 km) through November, but if all of the projects that are already approved or under review were to be completed, the country’s total mileage would grow by more than 8%. According to Canada’s National Energy Board, 3,628 miles (5,839 km) of pipeline projects have been approved for construction and another 2,807 miles (4,518 km) of projects are under review.

Like their counterparts in the Permian, Canadian producers have struggled with regionally depressed prices, as a lack of pipeline capacity has stranded production in oil-rich Alberta – so much so, that the province was reportedly in talks to buy rail cars to add approximately 120,000 bpd of capacity for about $263 million (C$350 million). By November, several Canadian crude producers had curtailed production and asked Alberta to mandate cuts for other producers.

The Trans Mountain expansion, which would nearly triple capacity on the line to 890,000 bpd, is among major Canadian pipeline projects that have suffered costly delays due to opposition from inside and outside of government. The Canadian government agreed in May to buy the pipeline from Kinder Morgan Canada Ltd for $3.5 billion (C$4.5 billion) in an effort to ensure its expansion went ahead. It is currently scheduled to be in service by December 2020. As part of the project, construction is already underway on an expansion at the Westridge Marine Terminal in Vancouver, with preliminary work being done at Kinder Morgan’s nearby terminal and tank farm.

AFRICA

Under Construction: 1,786

Planned: 18,196

Total: 19,982

Egypt and Cyprus signed an agreement in September for construction of a subsea pipeline to deliver natural gas from Cyprus’ Aphrodite field to Egypt’s liquefaction facilities in Idku for LNG production and export. Specifications of the pipeline have not been released, although costs have been estimated in a range of $800 million to $1 billion.

Kenya Pipeline Company (KPC), East Africa’s largest oil transporter was preparing to commission one of two new pipelines after 43 months of delays – a $480 million, 20-inch oil pipeline between Nairobi and Mombasa – when its CEO was arrested and other senior officials were charged with abuse of office and economic crimes in December. It is not yet known how or if these charges will affect plans for new KPC projects.

Separately, Kenya’s Ministry of Energy signed a joint development agreement with Tullow Oil, Africa Oil and Maersk Oil to carry out a study on the proposed 510-mile (820-km) Lokichar-Lamu crude oil pipeline to increase crude oil production in Turkana county to the north. That study is intended to lead to technical details and negotiations on financing and ownership structure. Preliminary estimates for the pipeline linking Lokichar oil fields to the coastal port town of Lamu show it would cost $2.1 billion and could be completed in 2021.

The Nigerian National Petroleum Corporation (NNPC) has announced plans to build the largest natural gas pipeline in its nation’s history: the Ajaokuta-Kaduna-Kano (AKK) pipeline. The 381-mile (614 km), 40-inch AKK pipeline is designed to provide connectivity between eastern and western sections of Nigeria to supply natural gas for power generation and industrial development in key commercial centers in its central and northern regions. NNPC hopes to complete the project by first half of 2020 at an expected cost of more than $2.8 billion.

ASIA-PACIFIC

Under Construction: 17,398

Planned: 13,953

Total: 31,351

China overtook Japan as the world’s top natural gas importer during 2018 and plans to more than double its pipeline infrastructure within the next seven years to nearly 150,000 miles. The expansion comes in response to growing energy demand and policies mandating a shift from coal to cleaner energy sources, which have boosted demand for gas and LNG imports. China’s National Development and Reform Commission said it plans to add about 80,000 miles to its current 69,600 by 2025. After expansion, natural gas pipelines will account for 76,400 miles, or 51% of the system.

Gazprom’s Power of Siberia gas pipeline construction is on track to begin delivering natural gas to China with completion this year. The 1,864-mile Power of Siberia will transport gas from the Irkutsk and Yakutia gas production centers to consumers in Russia’s Far East and to China via its eastern route, with 38 Bcm to be transported annually. Construction of the Power of Siberia began in 2014 and has involved construction of extensive gas processing infrastructure in Russia’s Far East.

China is exploring construction of a pipeline spur from Pakistan’s territory when TAPI begins operation, the head of Pakistan’s state-owned gas company said in August. The line could act as an alternative to Beijing’s plans to build a fourth China-to-Turkmenistan pipeline. China’s discussions with Pakistan regarding participation in TAPI date back to 2012.

Indonesia’s deputy energy minister in early December said Eni aims to start output of natural gas in 2021 from its offshore Merakes project, which includes construction of subsea systems and pipelines to transport production to a floating production unit (FPU).

Eni’s development plan calls for six subsea wells and the construction and installation of subsea systems and two 28-mile (45-km) pipelines that will be connected to the Jangkrik FPU. The gas will then be shipped through the existing pipelines to the Bontang LNG processing facility operated in East Kalimantan.

MIDDLE EAST

Under Construction: 581

Planned: 5,955

Total: 6,536

The construction of pipelines across countries and kingdoms has changed some political dynamics in the Middle East as the oil-dominant region turns increasingly to natural gas for domestic power and Israel and Egypt look to become exporters of natural gas and LNG, respectively.

Israel expects to make a decision early this year to move ahead with Cyprus and Greece on construction of the 1,243-mile pipeline East Med Pipeline, Israeli Energy Minister Yuval Steinitz said. The estimated $7 billion East Med project would cross from Israel and Cyprus into Greece and Italy in deep waters with an expected capacity of 9-12 Bcm annually. Project owners are IGI Poseidon, a joint venture between Greece’s natural gas firm DEPA, and Italian energy group Edison.

A third-quarter deal between companies operating in both Israel and Egypt to buy a stake in EMG pipeline provided a major step toward enabling Israel to export gas to Egypt. The $518 million purchase by Israel’s Delek Drilling, Texas-based Noble Energy and the Egyptian East Gas Co enables the supply of 64 Bcm of gas over 10 years from Israel’s offshore Tamar and Leviathan fields to Egypt as part of the export deal signed in February 2018.

Jordan and Iraq agreed in 2018 to a framework for construction of a 1,044-mile, twin oil and gas pipeline from Basra to Aqaba. When completed the project would move 1 MMbpd of oil and 258 MMcf/d of gas to its destination. The pipelines would eliminate exposure to terrorist activity at border crossings which have forced Jordan to find more expensive sources for most of its 134,000-bpd demand.

The leaders of Bahrain and Saudi Arabia inaugurated the recently commissioned AB-4 oil pipeline between the two kingdoms in November. The 68-mile (110-km), built through a collaboration between Saudi Aramco and Bahrain Petroleum Company (Bapco), included construction of a 26-mile offshore section connecting onshore segments in each country. It has a designed capacity of 350,000 bpd and is currently transporting 220,000 bpd from Saudi processing facilties at Abqaiq to a Bapco refinery in Bahrain. The estimated cost of the project was $300 million.

RUSSIA/FSU

Under Construction: 13,126

Planned: 9,841

Total: 22,967

Despite U.S. pressure and some European efforts to reduce EU dependence on Russian gas imports, government officials and executives told an industry conference in October they expected Russia would export a record amount of gas in 2018, potentially exceeding 200 Bcm and beating the all-time high of 194 Bcm set in 2017. Gazprom controls 35% of the gas market in Europe and expects to increase its share to 40% due to declining European production and the competitive cost of piped gas from Russia versus shipped LNG from the United States.

Russia’s Gazprom has completed the offshore sections of the TurkStream offshore gas pipeline, a 722-mile project across the Black Sea to Turkey that began construction in May 2017. Each of TurkStream’s twin, 32-inch pipelines have an annual throughput capacity of 15.75 Bcm. The first string of TurkStream is intended for Turkish consumers, while the second string will deliver gas to southern and southeastern Europe.

In November, Bulgarian officials decided to move ahead on a $1.59 billion (1.4 billion euros) gas link to Turkey that will enable transport of Russian gas from TurksStream to Europe, bypassing Ukraine to the South. The decision followed word that Gazprom was considering whether to book capacity in the Bulgarian gas system, which Bulgaria viewed as a sign of Russia’s intent to ship its gas from TurkStream to Serbia, Hungary and Austria through Bulgaria.

Bulgaria’s state gas network operator Bulgartransgaz planned to launch a binding open season in late December for the new 300-mile (484-km) gas pipeline. Moscow has also suggested it might consider an extension of TurkStream via Greece to Italy

Gazprom began pipelaying offshore Finland for its Nord Stream 2 project despite U.S. sanctions and opposition from some European countries. Nord Stream 2 was scheduled to start flowing natural gas from Russia’s Baltic coast to Germany by the end of 2019, running alongside the first Nord Stream pipeline, which was completed in 2011. It will render existing pipelines obsolete, including several pipelines that run through Ukraine, which stands to lose about $2 billion in annual transit revenues if gas is diverted away.

Construction commenced in 2018 on the Afghan section of the Turkmenistan, Afghanistan, Pakistan and India (TAPI) gas pipeline, and Uzbekistan announced it would join the $8 billion project. The 1,130-mile pipeline will deliver gas from Turkmenistan to Pakistan and India. TAPI reportedly received an investment from Saudi Arabia as it began construction on the difficult Afghan section, which runs abreast of the 346-mile Kandahar-Herat highway.

SOUTH & CENTRAL AMERICA

Under Construction: 3,639

Planned: 14,751

Total: 18,390

Argentina, home to the world’s second-largest shale gas reserves, began exporting natural gas to Chile in late October after a 12-year break as the two South American neighbors seek to increasingly integrate their energy supply and electricity grids.

The gas is being piped from the Vaca Muerta shale across the Andes mountains via the 20-inch, 585-mile (941-km) Atacama Pipeline, which was completed in 1999. Once a major supplier of natural gas to Chile, Argentina created diplomatic turmoil in the mid-2000s by cutting off shipments when its own supplies ran low.

Argentina is still a net energy importer, but government incentives to develop and create markets for the Vaca Muerta shale and Austral Basin are starting to produce results. Transportadora de Gas del Sur S.A. (TGS) committed to an initial $250 million project to add gas transportation infrastructure in the Vaca Muerta during 2018-2019, including a conditioning plant and a 57-mile, 36-inch gas pipeline that will cross 16 hydrocarbon areas with initial capacity of 37 MMcm/d, expandable to 56 MMcm/d.

Pipeline operations elsewhere in South America have been the target of attacks leading to oil spills and production disruptions. Canadian oil company Frontera Energy stopped production at Peru’s largest oilfield after a Petroperu pipeline was severed by indigenous protesters. State-owned Petroperu estimated the rupture spilled 8,000 barrels of oil, but said it shut off the flow of crude before any water sources were contaminated. Since 2016, nearly 20,000 barrels of oil have been spilled from the pipeline in at least 15 attacks, and another 5,600 barrels have leaked due to corrosion of mechanical failures, according to official estimates.

In neighboring Colombia, state-owned Ecopetrol said three new bombings of the 485-mile (780-km) Cano Limon pipeline caused contamination of several waterways in the country’s northeastern Arauca province. Cano Limon, which was targeted by illegal taps and more than 80 bombings in 2018, was out of service during the November attacks due to prior damage.

WESTERN EUROPE/EU

Under Construction: 4,508

Planned: 5,708

Total: 10,216

Europe remains a key battleground for global natural gas and LNG market share. As the United States and others target LNG markets and Russia continues to expand gas pipeline capacity to the continent, some construction activity is being driven by countries seeking to diversity supply sources.

Polish and Danish gas grid operators Gaz-System and Energinet agreed in late November to finance construction of the Baltic Pipe project, a 560-mile (900-km) pipeline that will reduce regional dependence on Russian supply by transporting Norwegian gas to Poland via Denmark. Costs of the project, which will cross the territories of Denmark, Sweden and Poland, are projected to range between $1.8 billion and $2.4 billion (1.6 billion to 2.1 billion euros). Gas transmission is expected to start in late 2022.

In addition to transporting Norwegian gas through Denmark to Poland and other countries in the region, Baltic Pipe also will enable reverse transmission from Poland to Denmark and Sweden, its developers said.

Norway is Europe’s second-largest natural gas supplier after Russia, providing about 25% of its gas needs. Most of its deliveries are via a network of offshore pipelines to Britain, Germany, France and Belgium. Norway’s Gassco said the Baltic Pipe project provides another export point but is not expected to affect export volumes.

Concerns over Russian expansion also served as motivation for a separate but related project: the Balticconnector natural gas pipeline. Balticconnector would allow gas imports via the GIPL pipeline, which is planned for completion between Poland and Lithuania by December 2021, and these systems could be connected to the Baltic Pipe. Balticconnector is co-owned by the Finnish natural gas transmission system operators Baltic Connector Oy, and its Estonia counterpart, Elering AS. Commercial operations are scheduled to start in January 2020.

Saipem’s Castorone completed laying Norway’s longest and largest oil pipeline to Equinor’s Johan Sverdrup field in September before starting its next job – laying a 97-mile (156-km) gas pipeline to transport Johan Sverdrup production to the existing Statpipe pipeline for delivery to Karsto. The 176-mile (283-km), 36-inch oil pipeline will be capable of transporting up to 660,000 bpd to Equinor’s Mongstad terminal. The Johan Sverdrup oil field, located 87 miles west of Stavanger, is being developed in two phases. Phase 1 is scheduled for startup in November 2019 with production capacity estimated at 440,000 bpd. Phase 2 is projected to be completed in 2022, expanding the field’s production capacity to 660,000 bpd.

Construction of a 113-mile pipeline between Greece and Bulgaria is scheduled for completion in 2020. The pipeline link was designed to transport gas from Azeri to Bulgaria, as well as some liquified gas from terminals in Greece. State-owned Bulgaria Energy Holding (BEH) reached a preliminary agreement with the European Investment Bank last summer for construction financing. ICGB, the project company for the gas link, said BEH is receiving preferential financing through a government-backed guarantee of $128 million. BEH holds a 50% stake in ICGB, while Greece’s DEPA state energy firm and Italy’s Edison each hold 25%.